Table of Contents

ToggleIntroduction

Section 2 [62] of the Companies Act, 2013 defines one person company [ OPC ] is a company that has only one person as a member.

OPC differs from a sole proprietorship in the aspect that OPC is a separate legal entity with the limited liability of the member. The liability of the owner is not restricted in the case of a sole proprietorship.

According to section 3 [1] (c) of the Companies Act, 2013 OPC is a private limited company with the minimum paid-up share capital as may be prescribed and has at least one member.

Significant Points to Remember

- There is only one person as a member.

- There is no limit prescribed in the minimum paid-up share capital.

- The memorandum of OPC shall indicate the name of the other person, who shall in the event of the subscriber’s death or his incapacity to contract, become a member of the company.

- The other person whose name is given in the memorandum shall give his prior written consent in the prescribed form. The same shall be filed with the registrar of companies at the time of incorporation.

- Such other person may be given the right to withdraw his consent.

- The member of OPC may at any time change the name of such other person by giving prior notice to the company. The company shall intimate the same to the registrar.

- Any such change in the name of the person shall not be deemed to be an alteration to the memorandum.

- Only a natural person who is an Indian citizen/NRI or a resident in India or has otherwise stayed in India for a period of not less than 120 days during the preceding financial year.

a) Will be eligible to incorporate OPC

b) Shall be a nominee for the sole member of an OPC

- No person shall be eligible to incorporate more than one OPC or become a nominee in more than such a company.

- No minor shall become a member of OPC or can hold share with beneficial interest.

- Under Section 8 of the Act, such a company cannot be incorporated or converted into a company. In some cases, it may be converted into public or private companies.

- Such companies cannot undertake non-banking financial investment activities including investment in securities of any corporation.

- If such company or any officer of such company contravenes the provisions, they shall be punished with a fine which may extend to ten thousand rupees and may also be liable to a fine. This may be increased to Rs 1,000 for every day after the first occurrence of such a violation during the competition.

OPC Registration Process

To register One Person Company (OPC) in India, you can follow the online registration process through the MCA portal by following these steps.

Step-1 Apply for DSC

The first step is to apply for Digital Signature Certificate in which you need the following documents.

- Passport

- PAN Number

- Driving License

- Photograph

- Email Id

- Phone Number

Step-2 Apply for DIN

The next step after applying for DSC is to apply for Director Identification Number. The documents you need for DIN are as follows.

- Passport

- Aadhar Card

- Electricity Bill

- Voter Id

Step-3 Name Availability

The next step regarding OPC registration is to apply for name approval by giving a name for reservation. The name of the OPC will be registered as OPC [Company Name] Private Limited.

Step-4 MOA and AOA

The next important step after your company name is approved is to get a certified copy of MOA and AOA through MCA. You can apply from MCA.GOV.IN

Step-5 Certificate of Incorporation

After completing all the legal formalities of registration, the last step is to obtain the Certificate of Incorporation from the ROC.

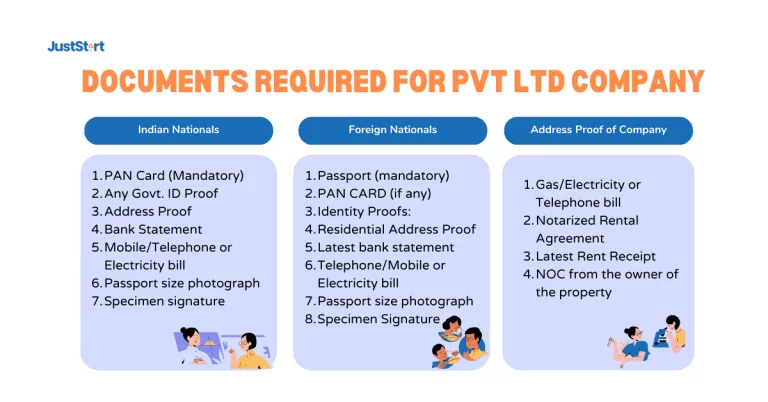

Documents Required for OPC Registration

- PAN Card

- Aadhar Card

- Passport Size Photograph

- Telephone Electricity Bill/Water Bill

- Bank Account Statement

ADVANTAGES

- In an OPC there is limited liability of the members in extent to the unpaid subscription money.

- It is easy to get loans from banks as compared to a sole proprietorship.

- There is complete control in your hands in an OPC.

- It is easy to manage as compared to the other registered companies.

- The profit belongs only to the single-member that is the owner of the company.

Frequently Asked Questions

Who is eligible to act as a member of OPC?

A natural person who is an Indian citizen/NRI or a resident in India is eligible to become a member or nominee of the company.

What is the difference between OPC and a Private Limited Company?

OPC is a company whose sole member is the owner of the company. In a private company, the company must have two members and the maximum limit of members is two hundred.

How many directors should be there in an OPC?

OPC requires at least one director to manage the board meetings. However, the maximum limit of directors is fifteen.

Also Read- How To Apply for Private Limited Company Online in India