One of the important aims of any country is to promote its economic growth, and a small finance company, commonly known as a microfinance company, has the potential to do it. These companies not only alleviate poverty but also help in overall community development. They focus on the future prospects of the economy and market conditions.

A microfinance company is an entity that provides multiple financial services to people and enterprises. These companies play a very important role in our economic growth. It regulates the flow of money and capital in the market. They have a very strong social impact on a community and empower individuals to explore opportunities.

Table of Contents

ToggleImportance of a Microfinance Company

Microfinance businesses in India are definitely making better changes. They support people and enterprises that don’t get loans or any help from traditional banking services. Small finance businesses work to provide small loans, savings accounts, or any financial services to low-income communities. This encourages entrepreneurs and helps them to participate in economic growth.

These companies are a very powerful tool to have an impact on gender equality because a notable portion of microfinance clients are women. This encourages women to be independent and decision-makers for a better future. They also act as a helping hand in unexpected crises; individuals get supported by them. They are very helpful and agents of change.

Formation of a Microfinance Company

Finance is a very regulated business in any country, and its security is of the utmost importance. And that’s why only a bank or an RBI-authorized non-banking finance company (NBFC) can do the financial dealings in India. NBFC is an entity that is operated to provide loans or money lending with an approved licence from the RBI. It is also known as a microfinance company.

Registration of a Microfinance Company as an NBFC

Registration gives you all the legal rights to operate a business. So let’s now understand the registration process for small finance companies in India.

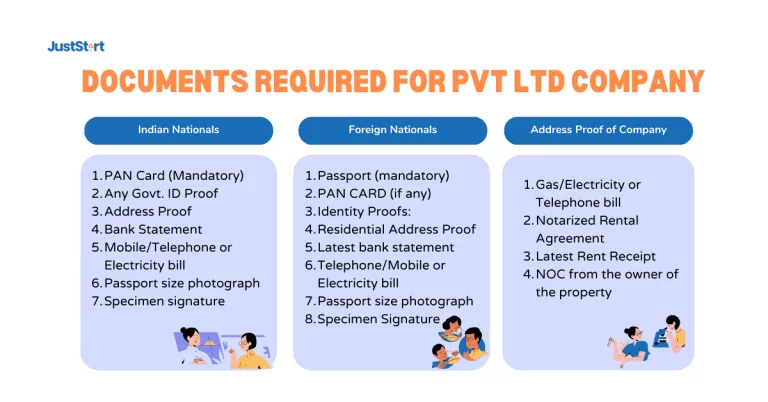

Register a Private Limited Company under the Companies Act, 2013

The very first step is to choose a unique name for your company that is not already registered by any other company. Then file the required documents to obtain the digital signature certificate and director identification number. These certificates ensure the security and validity of the Ministry of Corporate Affairs.

Prepare the MOA and AOA and submit them to the Registrar of Companies. All your documents will be verified by the RoC, and after his approval, you’ll receive your Certificate of Incorporation.

Increasing the Paid-Up Capital to 10 Crores

As per the revised notification issued by the RBI, the net worth requirement to register a microfinance NBFC now stands at 10 crore. Therefore immediately after incorporation, the paid up capital needs to be increased to 10 crore to match the above requirement. But you can’t increase your paid-up capital without the approval of your company’s shareholders.

Obtain proper documentation of the resolutions passed during the meeting. You’ll then need to amend the AOA to show the increase in paid-up capital. And update the details of the new share issuance. Then file these documents and submit them to RoC with the required fees. This is a necessary step for verification.

Make a Fix Deposit of 10 Crores with the Bank

The next step is to deposit the 10 crores in a separate bank account and obtain a no-lien certificate from the said bank against the deposit made. This is an important document to file along with the application for a microfinance NBFC.

Review and Approval for a license

Submit all the supporting documents and a hard copy of the application to the regional office of the Reserve Bank of India. Carefully review the needs and requirements of the RBI to ensure completeness before submitting.

Attachments required while filing the application are:

- Certificate of Incorporation

- Auditors’ Report

- Bankers’ Report

- Cibil history of all directors, etc.

After all the documents are submitted, the RBI will check their reliability very carefully and precisely. They also make sure to check the detailed history of the company. And if satisfied, RBI will issue an NBFC Registration Certificate, which will be your approval to legally start your small finance company.

Limitations of a Microfinance Company

Even though microfinance companies have multiple benefits, they still have some limitations as well. This also affects their growth and development. It is also necessary to overcome these challenges with strategic planning for the thriving future of the company.

Here are a few limitations of a microfinance company:

- Limited Resources

- Risk management challenges

- Regulatory Compliance

- Scalability Concerns

- Market Competition

Conclusion

A small finance company is definitely a very good idea to go for. They are encouraging entrepreneurs, empowering women, reducing poverty, and overall community development. These businesses provide personalized services as per the needs of a specific client. It has flexibility and requires quick decision-makers. But understand it carefully before you try to fit in your interests and abilities. The registration procedure may also vary depending on the area of the company. And that’s why it is advisable to consult a legal professional to avoid mishaps.