OVERVIEW

What is a Private Limited Company in India?

A private limited company is a business entity registered under the Companies Act, 2013. It offers limited liability and a separate legal identity to its shareholders. This type of company must have at least two directors and shareholders. There are some restrictions on share transfers to maintain control and confidentiality. Key legal characteristics include limited liability, ongoing existence, statutory compliance, and structured governance.

Compared to limited liability partnerships, which are ideal for professionals, or a one-person company suited for solo entrepreneurs, a private limited company allows for better growth and credibility. It provides more legal protection and funding options than a sole proprietorship, which has unlimited liability and lacks a separate legal identity. This makes it the top choice for startups and expanding businesses that want long-term stability and investor confidence.

To register a private limited company in India, the following criteria must be met:

- A minimum of 2 Directors and 2 Shareholders are required.

- At least one director must be an Indian resident and an Indian citizen.

- The registered office of the company must be located in India.

- Directors can also hold shares in the company.

Types

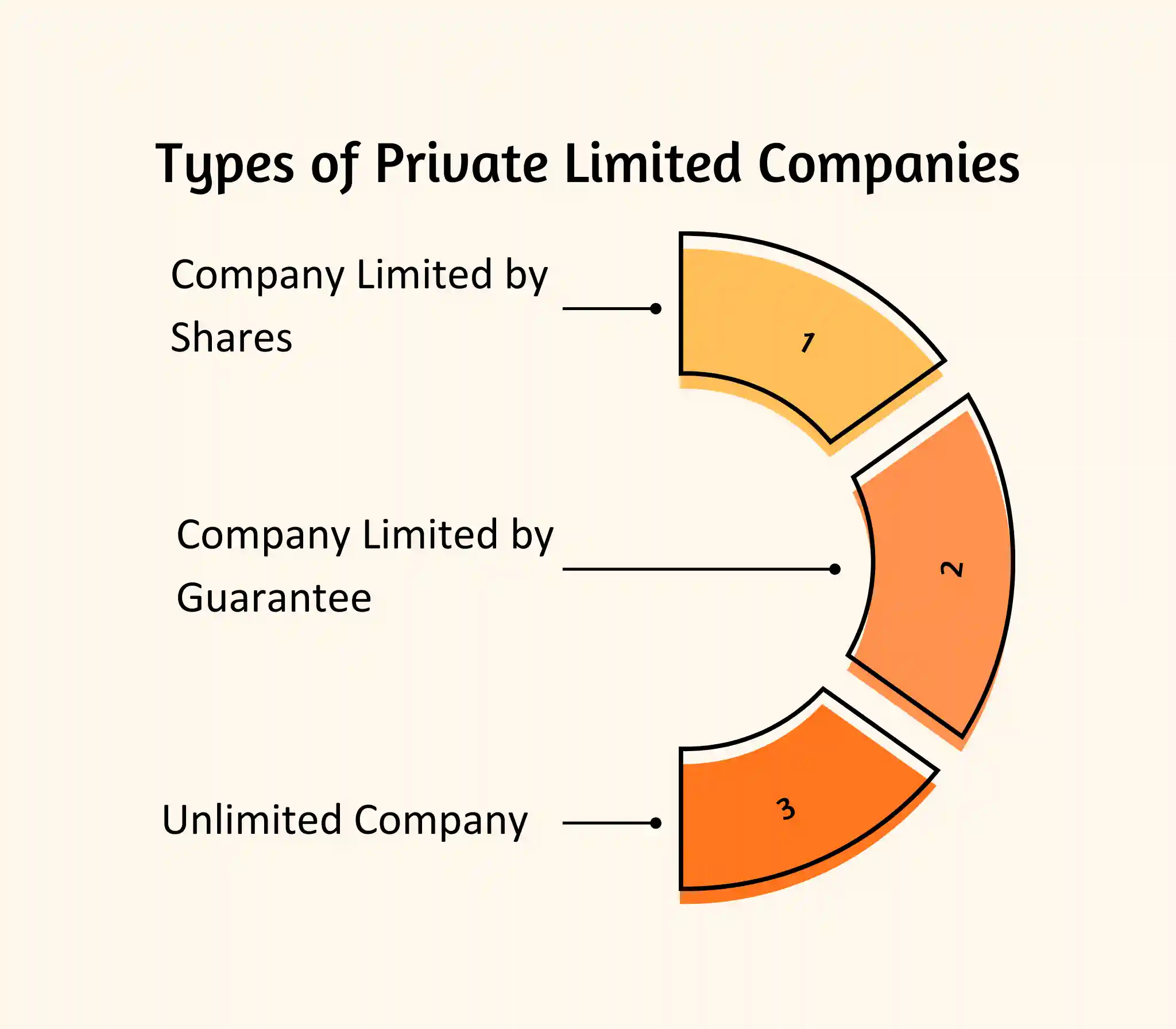

Types of Private Limited Companies in India

Private Limited Companies in India can be categorized based on different structures such as legal ownership, liability structure, and purpose. Here are the main 3 categories recognized under the Companies Act, 2013.

Company Limited by Shares:

A Company limited by shares means the members have the liability limited to their amount invested in the company shares.

Company Limited by Guarantee:

A Company limited by guarantee means the members have the liability limited to the specific amount they have agreed to contribute to the assets of the company when in case of wound up. Non-profit companies often use this type of business structure.

Unlimited Company:

An Unlimited Company means the members are not protected by limited liability and are personally liable for the company’s debt beyond their initial investment.

Benefits

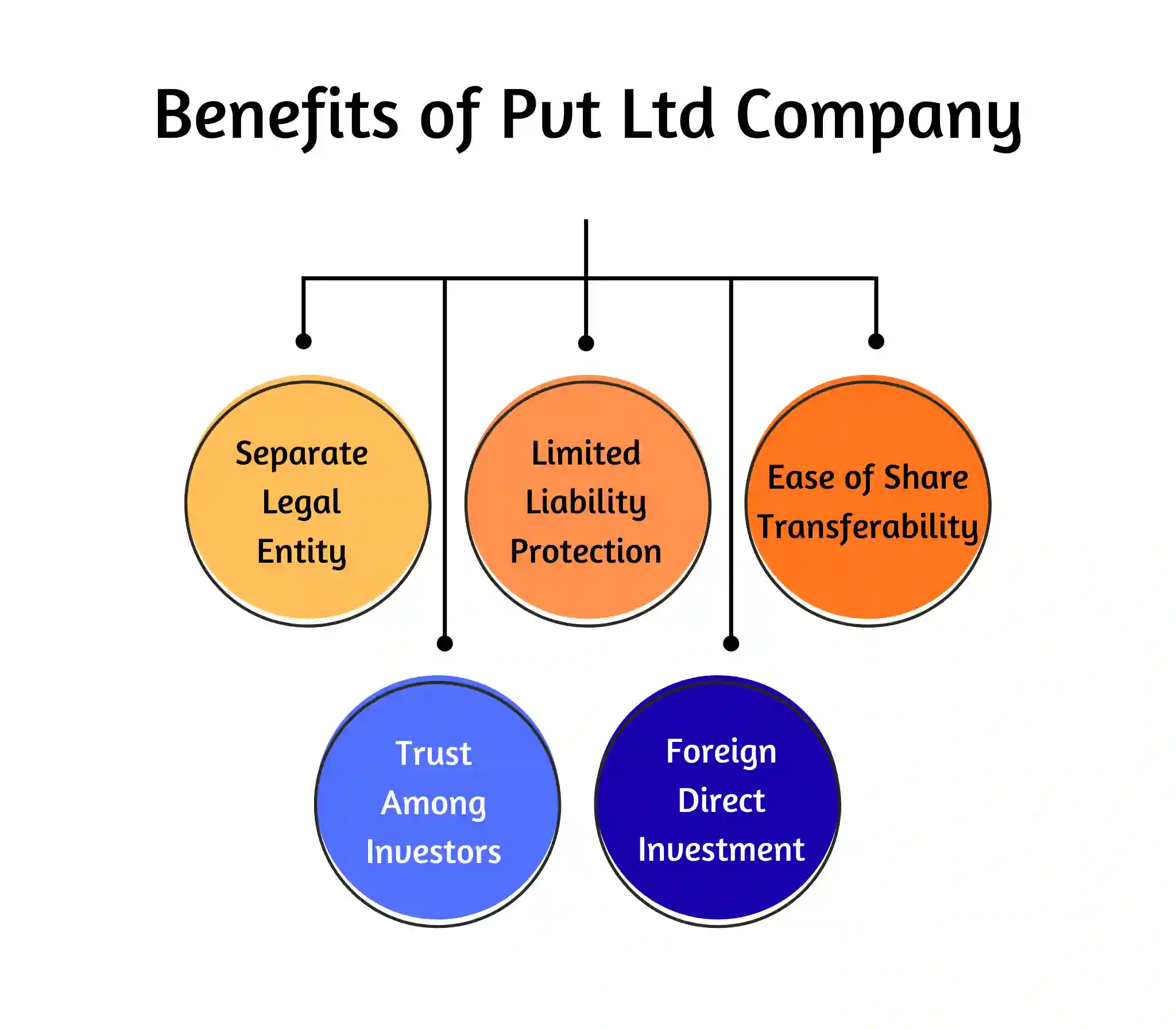

Benefits of Pvt Ltd Company Registration

Pvt Ltd Company Registration has several benefits due to its flexibility and ease of raising equity financing. Below are the key benefits of Pvt Ltd Company Registration-

Separate Legal Entity:

Pvt ltd company registration has the benefit that it is a separate legal entity from its members. It means that a business can work independently from its owners.

Limited Liability Protection for Shareholders:

Shareholders have limited liability, meaning that if the company faces financial losses, the shareholders are only liable to pay back the amount they invested in the company. This protects personal assets from business risks.

Ease of Share Transferability:

Private limited companies allow shareholders to transfer shares easily and freely between themselves. This enhances flexibility and business adaptability.

Trust Among Investors and Vendors:

It has one more benefit, that if a person has a pvt ltd company, then the trust among investors and vendors is more due to its limited liability and more transparency.

Foreign Direct Investment (FDI) Opportunities:

Private limited companies are eligible to raise Foreign Direct Investment (FDI), which can provide access to international funding and growth opportunities.

Business Continuity:

A major advantage of a private limited company is legal perpetuity. The company continues to exist even if one of the shareholders dies, becomes insolvent, or files for bankruptcy. This ensures business stability over time.

If you have plans for expansion, growth, or high investment opportunities, then private limited company registration is the ideal option for you. Company Registration offers numerous advantages, especially if you’re aiming for business expansion, strategic investments, or international opportunities. Learn how you can register your company in India today with JustStart!

Minimum Requirements

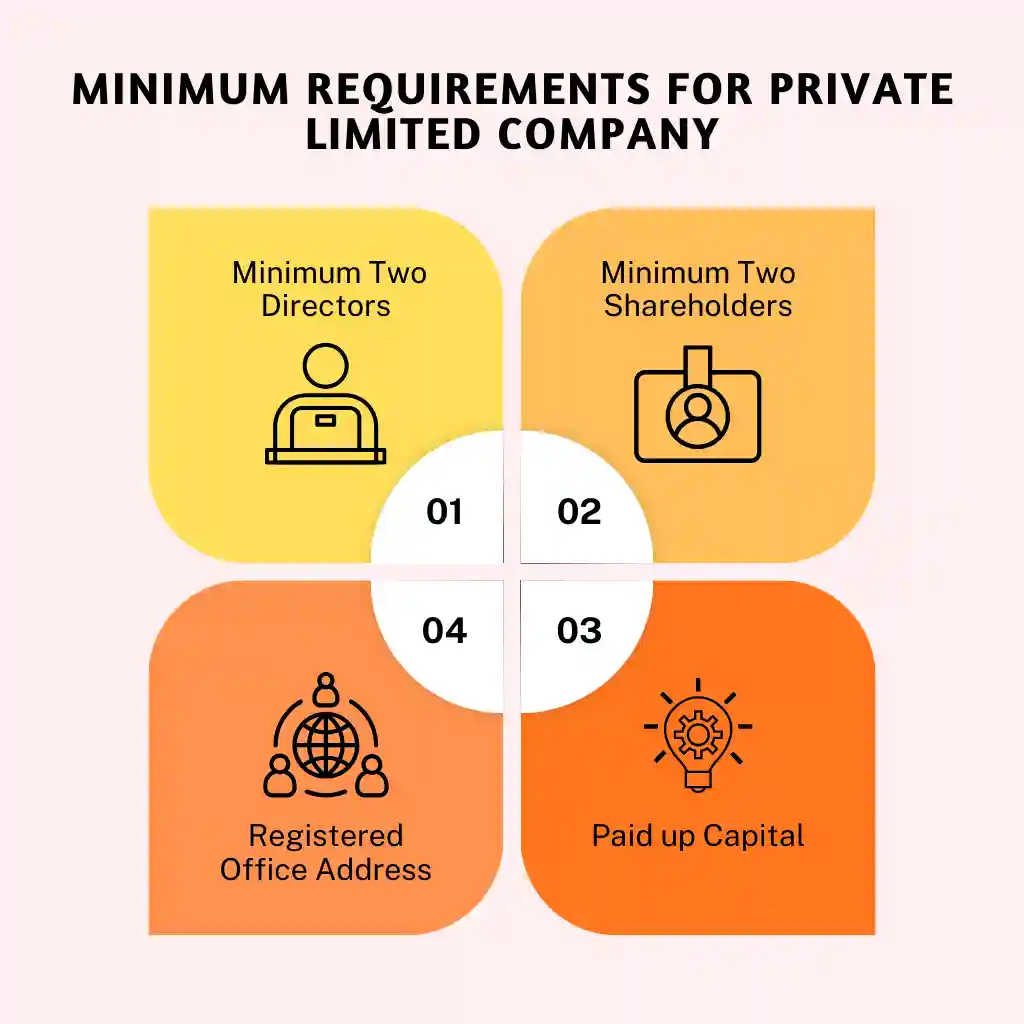

Minimum Requirements for Private Limited Company Registration

Starting a Private Limited Company in India requires careful attention to certain requirements and compliance with the Companies Act, 2013.

Key Requirements for Pvt Ltd Company Registration

Below are the essential minimum requirements for a successful Pvt Ltd Company Registration Online:

✅ Minimum Two Directors

- A private limited company must have two directors at a minimum.

- Out of the two, at least one director must be an Indian resident and citizen.

- The maximum number of directors allowed is 15.

✅ Registered Office Address

- The registered office must be in India.

- A commercial address is not mandatory—you can use a residential address or rented property.

- If you choose a rented property, a No Objection Certificate (NOC) from the landlord is required.

✅ Capital Structure

There is no minimum capital requirement for a private limited company. Shareholders can contribute any amount of capital as per their financial planning.

Process

Step-by-Step Private Limited Company Registration Process

Registration of a private limited company is a simple process with expert guidance. With the right documentation and compliance with legal requirements, your company registration in just a few steps.

_1770964986.webp)

Step: Name Reservation via SPICe+ (Part A)

Submit the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) form for company name reservation.

If a name approval letter is desired, it can be requested at this stage. Alternatively, you can directly submit all required documents to the Ministry of Corporate Affairs (MCA) for quicker processing.

Step: Obtain Digital Signature Certificates For Directors

A Digital Signature Certificate (DSC) is mandatory for signing all electronic forms submitted to the MCA.

To obtain a DSC, directors must provide:

- Identity proof (e.g., PAN card or passport).

- Passport-sized photograph.

- Contact details (email ID and phone number).

JustStart can help you obtain DSCs through an authorized certifying authority

Step 3: Incorporation Forms (SPICe+ Part B, eMOA, eAOA, AGILE-PRO)

Once the information and documents are ready, the following forms need to be filed:

- SPICe+ for incorporation details.

- SPICe MOA (Memorandum of Association).

- SPICe AOA (Articles of Association).

- AGILE PRO for GSTIN, ESIC, and EPFO registration.

- INC-9 for the declaration by the company’s directors.

The MCA reviews the submitted forms and, upon approval, issues:

- Certificate of Incorporation (COI).

- Permanent Account Number (PAN).

- Tax Deduction and Collection Account Number (TAN).

Step: Issuance of Certificate of Incorporation

Upon successful verification by the MCA, the company will receive its Certificate of Incorporation, marking its official establishment.

Documents Required

Documents Required for Pvt Ltd Company Registration

Documents For Indian Nationals

For individual

- Passport-size photograph

- PAN Card (Mandatory)

- Any govt ID proof (Voter ID card, Aadhar card, driving license, passport )

- Address proof (electricity bill, telephone bill, bank statement, gas bill )

- Mobile number & Email I’d

For the Address Proof of the Company

The electricity bill is in the name of the premises. If not, then a notarized rental agreement/ NOC from the owner of the property is required.

Documents For Foreign Nationals

For Individual - Foreign Nationals

- Passport-size photograph

- PAN Card (Mandatory)

- Any govt ID proof (Voter ID card, Aadhar card, driving license, passport )

- Address proof ( electricity bill, telephone bill, bank statement, gas bill) of the country he is residing in.

- Mobile number & Email I’d

For the Address proof of the company

The electricity bill is in the name of the premises. If not, then a notarized rental agreement/ NOC from the owner of the property is required.

All the above-mentioned documents should be notarized, especially in the case of an NRI in India (a Commonwealth country). In case of a non-Commonwealth country, then all the documents should be notarized /Apostilled/attested as per the Hague Convention or by the Indian Embassy as per the Companies Act,2013.

Certificate of Registration

Certificate of Incorporation – What It Means and Why It Matters

A Certificate of Incorporation is an official document that is issued by the Registrar of Companies (ROC) stating that your business is registered under Indian law. It proves that the company has completed all the required steps of incorporation. It can also be recognized as a Business registration certificate.

A company registration certificate is significant as it substantiates the company's legal existence and identity. It is one of the legal documents that contains the most important information regarding the company, which includes its name, address, date of incorporation, and corporate identification number.

Certificate of incorporation is the most important document, just like for an individual to have their date of birth. It is legal evidence that serves as proof of its existence.

Timeframe

Timeframe of Private Limited Company Registration

The entire process can be completed within 10-15 working days, provided all required documents are submitted accurately and on time.

|

Step |

Process Description |

Estimated Timeframe |

|

1. Digital Signature Certificate (DSC) |

Obtaining DSC for all proposed directors. |

1–2 working days |

|

2. Director Identification Number (DIN) |

Applying for DIN (if directors don’t already have one). |

1 working day |

|

3. Name Approval (RUN or SPICe+ Part A) |

Submitting 2 name options to MCA for approval. |

2-3 working days |

|

4. Drafting of MOA & AOA |

Preparing the Memorandum & Articles of Association. |

1 working day |

|

5. Filing SPICe+ Form |

Submit the incorporation form with the MCA along with documents. |

1 working day |

|

6. Verification by RoC |

Registrar of Companies reviews the application & documents. |

7-8 working days |

|

7. Issue of Certificate of Incorporation |

Once approved, MCA issues the Certificate of Incorporation (COI) with PAN & TAN. |

1 working day |

|

Step |

Process Description |

Estimated Timeframe |

|

1. Digital Signature Certificate (DSC) |

Obtaining DSC for all proposed directors. |

1–2 working days |

|

2. Director Identification Number (DIN) |

Applying for DIN (if directors don’t already have one). |

1 working day |

|

3. Name Approval (RUN or SPICe+ Part A) |

Submitting 2 name options to MCA for approval. |

2-3 working days |

|

4. Drafting of MOA & AOA |

Preparing the Memorandum & Articles of Association. |

1 working day |

|

5. Filing SPICe+ Form |

Submit the incorporation form with the MCA along with documents. |

1 working day |

|

6. Verification by RoC |

Registrar of Companies reviews the application & documents. |

7-8 working days |

|

7. Issue of Certificate of Incorporation |

Once approved, MCA issues the Certificate of Incorporation (COI) with PAN & TAN. |

1 working day |

At JustStart, we specialize in simplifying the private limited company registration process. Let us handle the paperwork, ensure compliance, and guide you every step of the way.

Pvt Ltd Vs LLP Vs OPC Vs Proprietorship

Private Limited Company vs Other Business Structures

Here’s a complete guide of a Private Limited Company Vs Other business structures in India:-

|

Feature |

Private Limited Company |

Limited Liability Partnership (LLP) |

One Person Company (OPC) |

Sole Proprietorship |

Partnership Firm |

|

Legal Identity |

Separate legal entity distinct from owners |

Separate legal entity |

Separate legal entity |

Not a separate entity |

Not a separate entity |

|

Owner Liability |

Limited to shareholding |

Limited to contribution |

Limited to contribution |

Unlimited personal liability |

Unlimited personal liability |

|

Minimum Members Required |

2 Directors, 2 Shareholders |

2 Designated Partners |

1 Director & Shareholder |

1 Proprietor |

2 Partners |

|

Maximum Members Allowed |

200 shareholders |

No limit |

1 person only |

1 person only |

20 partners (10 in banking) |

|

Foreign Investment (FDI) |

Allowed under automatic route |

Allowed with compliance |

Not allowed |

Not allowed |

Not allowed |

|

Funding Eligibility |

Eligible for equity funding, VC/PE |

Limited funding options |

Limited to debt only |

Not eligible |

Not eligible |

|

Transferability of Ownership |

Shares easily transferable |

Needs partner approval |

Cannot transfer OPC |

Not transferable |

Requires a new agreement |

|

Statutory Audit Requirement |

Mandatory regardless of turnover |

If turnover > ₹40 lakhs or capital > ₹25 lakhs |

Mandatory |

Not mandatory |

Not mandatory unless a tax audit applies |

|

Compliance & Filings |

Moderate to High |

Moderate |

Moderate |

Minimal |

Minimal |

|

Management Structure |

Directors manage the company |

Partners manage the LLP |

Single-owner managed |

Owner-managed |

Partner-managed |

|

Taxation |

Flat 22% (with MAT provisions) |

Flat 22% |

Flat 22% |

As per the individual slab |

As per the individual slab |

|

Name Suffix Requirement |

Must include “Private Limited” |

Must include “LLP” |

Must include “OPC Pvt Ltd” |

No restriction |

No restriction |

|

Compliance with MCA |

Mandatory (ROC filings, annual return, etc.) |

Required |

Required |

Not applicable |

Not applicable |

|

Reputation & Credibility |

Highly trusted by investors and banks |

Moderate |

Moderate |

Low |

Low |

|

Feature |

Private Limited Company |

Limited Liability Partnership (LLP) |

One Person Company (OPC) |

Partnership Firm |

|

Legal Identity |

Separate legal entity distinct from owners |

Separate legal entity |

Separate legal entity |

Not a separate entity |

|

Owner Liability |

Limited to shareholding |

Limited to contribution |

Limited to contribution |

Unlimited personal liability |

|

Minimum Members Required |

2 Directors, 2 Shareholders |

2 Designated Partners |

1 Director & Shareholder |

2 Partners |

|

Maximum Members Allowed |

200 shareholders |

No limit |

1 person only |

20 partners (10 in banking) |

|

Foreign Investment (FDI) |

Allowed under automatic route |

Allowed with compliance |

Not allowed |

Not allowed |

|

Funding Eligibility |

Eligible for equity funding, VC/PE |

Limited funding options |

Limited to debt only |

Not eligible |

|

Transferability of Ownership |

Shares easily transferable |

Needs partner approval |

Cannot transfer OPC |

Requires a new agreement |

|

Statutory Audit Requirement |

Mandatory regardless of turnover |

If turnover > ₹40 lakhs or capital > ₹25 lakhs |

Mandatory |

Not mandatory unless a tax audit applies |

|

Compliance & Filings |

Moderate to High |

Moderate |

Moderate |

Minimal |

|

Management Structure |

Directors manage the company |

Partners manage the LLP |

Single-owner managed |

Partner-managed |

|

Taxation |

Flat 22% (with MAT provisions) |

Flat 22% |

Flat 22% |

As per the individual slab |

|

Name Suffix Requirement |

Must include “Private Limited” |

Must include “LLP” |

Must include “OPC Pvt Ltd” |

No restriction |

|

Compliance with MCA |

Mandatory (ROC filings, annual return, etc.) |

Required |

Required |

Not applicable |

|

Reputation & Credibility |

Highly trusted by investors and banks |

Moderate |

Moderate |

Low |

Post-Incorporation

Post-Incorporation Compliance Checklist

Post incorporation compliance purpose is to ensure that all the compliances of the company operate according to the ethical and legal standards. Compliances need to be filed on time to avoid late penalties. Now let’s discuss the mandatory compliances for a private limited company in India:-

_1763037417.gif)

Appointment of Auditor:

The ADT-1 form is to be filed for the appointment of an auditor. This form needs to be filed within 30 days from the date of incorporation. If a new auditor is appointed, it will be within 15 days before the date of the annual general meeting of the company in the form ADT-1 with the ROC.

Commencement of Business Form:

INC-20A form will be filed for the commencement of business. This form needs to be filed within 6 months from the date of incorporation. This form is mandatory because this form can be filed with details like the company’s bank account, shareholders' subscriber’s amount, the company’s board photo with the directors, etc.

Director’s KYC:

DIR- 3KYC form will be filed for updating the information of the directors every year. This form is mandatory to file every year to keep updating the directors data on the MCA; otherwise it will be levied a penalty of Rs. 5000 per director.

Return of Deposits:

Form DPT-3 requires information on deposits and non-deposits taken by the company. If the company doesn't have any deposits, then it will not be required to file the form.

Financial Statements Return:

Form AOC-4 is one of the most important compliances for a pvt ltd company, it will be filed with the financial statements, like the audited balance sheet of the company, with the registrar of companies within 30 days from the date of the annual general meeting of the company. It contains all the company's disclosures, like turnover, board meetings, net worth, etc.

Annual Return:

The company will submit the disclosures of the list of shareholders with Form MGT-7. This form needs to be filed within 60 days from the date of the annual general meeting.

Income Tax Return:

Every company has to file the income tax return by 31st October of every assessment year.

If someone does not file the above mandatory forms on time, the company will be non-compliant and levy high penalties. It is preferable to complete the compliance after incorporation to avoid late fees and penalties.

Why Choose JustStart?

Why Choose JustStart for Private Limited Company Registration?

When it comes to Pvt Ltd Company Registration in India, having expert legal assistance can simplify the process and ensure compliance. At JustStart, we specialize in making company registration seamless and stress-free for our clients.

Comprehensive Legal Expertise

Our team consists of experienced MBAs, CAs, CS, Lawyers, and Accountants who specialize in corporate law and company incorporation.

With our expertise, we will handle your Private Limited Company Registration efficiently and professionally.

100% Online Process

Enjoy the convenience of registering your company online without stepping out of your office or home.

Our hassle-free digital process ensures minimal paperwork and maximum efficiency, saving you time and effort.

Personalized Client Support

We prioritize client satisfaction, offering tailored solutions to meet your specific business needs.

Our team provides consistent legal support to help you overcome any legal challenges that arise during or after the registration process.

Proven Strategies for Success

Our legal consultants not only help with registration but also provide refined strategies to ensure the smooth operation and growth of your business.

With JustStart, you can focus on scaling your business while we handle the legalities.

Trusted Partner for Entrepreneurs

We have successfully helped numerous businesses register their Private Limited Companies.

Let us take care of the paperwork, legalities, and compliance so you can focus on your vision.

Let us take care of the paperwork, legalities, and

compliance so you can focus on your vision.

Locations

Private Limited Company in Other States and Cities

FAQ

LET'S CLEAR ALL THE DOUBTS!

There is no minimum capital requirement to start a pvt ltd company as specified in the Companies Act.

Authorized Capital is the highest amount of money a company can collect by selling shares, according to its rules and the Paid-up Capital is the actual money that shareholders have given to the company for those shares.

The Director Identification Number (DIN) is a unique number given to anyone who wants to be a director of a company in India. It helps keep track of all directors.

A Digital Signature Certificate (DSC) is an electronic form of a signature used to verify the identity of the person signing digital documents. Anyone who needs to sign digital documents, such as company directors, business owners, or professionals filing government forms online, should obtain a DSC.

Yes, you can use your home address as your company’s official address, as long as it’s okay with the rules and can handle any mail or notices the company gets.

Yes, a private company can handle different businesses or activities. It can have several types of businesses under one company name, as long as it follows the rules and regulations for each type of business.

The Mandatory compliances for a private limited company include filing annual returns, maintaining statutory registers, holding annual general meetings (AGMs), filing income tax returns, and following Company Law requirements.

The Registrar of Companies (ROC) is a government official responsible for overseeing and regulating the registration, compliance, and legal matters of companies and limited liability partnerships in a specific region or state.

A Private Limited Company Registration gives you limited liability, so you’re only responsible for what you invest. It also makes your company look more trustworthy, helps you raise money more easily, and provides tax benefits.

Yes, a Private Limited Company in India needs a real physical address where it can receive mail and official documents. This address can be a business or home address, or a virtual office address.

Yes, NRIs (Non-Resident Indians) and foreign nationals can become directors of a Pvt Ltd Company in India. However, at least one director must be a resident of India.

Click here to read more about Company Registration for Foreigners & NRIs

Private Limited Companies registered in India are required to file their Income Tax Returns every year using Form ITR-6.

A director is responsible for managing and making decisions for the company, while a shareholder owns shares in the company and has a stake in its profits.

A Private Limited Company in India needs GST registration if its turnover exceeds the threshold limit or if it sells taxable goods or services.

For Pvt Ltd Company Registration, it needs at least two directors in India.

You can check the availability of a company name through the MCA (Ministry of Corporate Affairs) portal using the “RUN” (Reserve Unique Name) service. The system verifies if the name is unique, not identical or too similar to an existing company or trademark, and complies with MCA naming guidelines. Once approved, you can go through the name reservation for your company incorporation.

A Private Limited Company must file its income tax return using Form ITR-6 if it is not claiming exemption under Section 11 (income from property held for charitable or religious purposes). Filing must be done electronically on the Income Tax Department’s e-filing portal before the due date specified under the Income Tax Act.

No, a Private Limited Company cannot raise funds from the public. It is restricted from inviting or accepting public deposits. However, it can raise capital through private funding methods such as issuing shares to existing shareholders, venture capitalists, private equity investors, or by borrowing from banks and financial institutions.