OVERVIEW

Understanding the Closure of a Limited Liability Partnership

A Limited Liability Partnership (LLP) is a type of business structure that provides various benefits, like less stringent compliance comparable to private limited companies, and at the same time, it is one that is easily dissolved when the circumstances of the business change, be it financial constraints, retirement of partners, or achieving your business goals.

Usually, the business owners will put off this process, thinking that it would be difficult or expensive. But the truth is that closing an inactive LLP is much less complicated than fulfilling the compliance requirements for a working business. Furthermore, keeping an inactive LLP alive without going through the closure filing process can lead to daily fines of ₹100 with no maximum limit, which can very quickly turn into a huge liability.

The secret to an easy and quick closure is in the knowledge of the eligibility criteria, having the right documents ready, and taking the legal procedure step-by-step compliance.

_1731068077.jpg)

Eligibility Criteria

When Can You Close Your LLP?

The LLPs that have decided to wind up are not allowed to close right away, but it depends on the law, which has put down strict eligibility conditions that need to be met before the filing for closure can take place.

_1764833308_1768547841.png)

Your LLP could be closed down if it satisfies any of these criteria:

Inoperative from Incorporation:

LLP has not started its business operations at all since the time it was registered with the Ministry of Corporate Affairs (MCA). This is the case of LLPs that were registered for a particular project that never took place or businesses that never got off the ground.

Inactive for One Year or More:

LLP has completely stopped all its business activities at least a year ago. This timeframe is considered enough to conclude that the business will not come back. For instance, if your LLP's last transaction date is January 15, 2025, you can apply for closure anytime after January 15, 2026.

No Outstanding Assets or Liabilities:

LLP at the time of filing for closure must have no assets and no liabilities. The entity must have paid off all its debts, collected all its receivables (or written them off), and completed all its obligations. This is a very important condition since the law does not permit the closure of LLPs having financial issues that are not resolved.

All Partners Consent to Closure:

Every single designated partner must provide written agreement for the dissolution. The consent of all partners is a strict requirement; even one dissenting partner has the power to stop the closure process.

All Statutory Returns Filed:

Your LLP has to make sure that it has filed all the statutory annual returns till the financial year in which it ceased to operate before it can apply for closure. This includes Form 8 (Statement of Accounts & Solvency) and Form 11 (Annual Return).

Strike Off vs Voluntary Winding Up

Two Methods to Close Your LLP Company

There are two different ways according to the law to close an LLP, and each method is suitable for different business situations. The choice of the method will depend on the financial status and operational history of your LLP.

Strike Off (Also Called Striking Off or Removal from Register)

Most LLPs use this method as the most common and straightforward method. It involves removing your LLP's name from the MCA register once it is no longer active and has no financial issues that need to be resolved.

When to Choose Strike Off:

This method is specifically designed for LLPs that have not been conducting any business operations for one year or more, have no debts that are due, and have no liabilities that are pending. It is the quicker, the less costly option for businesses that simply ceased operation and left no financial loose ends.

Advantages:

- Faster process (normally 3-6 months), Lower cost (₹500-₹1,000 government fee and professional fees)

- Simpler documentation requirements, no need for liquidators or tribunal involvement

- Immediate relief from annual compliance obligations

Disadvantages:

- Designated partners continue to be liable for claims connected with liabilities that occurred before closure, even after the LLP has been struck off

- Not for LLPs that have assets to be evenly distributed among partners

- Cannot be applied if there are legal disputes or pending litigations that have not been resolved0

Voluntary Winding Up

Voluntary winding up is one of the methods of business closure that includes formal liquidation, a more extensive method of closure. The partners come to a consensus and pass a resolution that the business is to be wound up, then they appoint a licensed liquidator to dispose of the company's assets and pay its debts, and finally, they ask the court for dissolution.

When to Choose Voluntary Winding Up:

It is necessary to go for this method when the LLP has assets to be liquidated, and it has liabilities that can only be settled by selling the assets, and the partners want to be completely legally closed with full protection from future liability claims.

Advantages:

- The partners are completely protected from any future claims related to liabilities once the dissolution is complete.

- The assets are sold off and distributed in accordance with the partnership agreements.

- Officially dissolved with the tribunal's supervision

- Ideal for Complex business situations

Disadvantages:

- The timeline is several times longer (12-24 months or longer)

- Liquidators, attorneys, and tribunal costs are the main sources of higher expenses

- Increased document complexity and filing requirements

- The liquidator has to be licensed

For the most part, the strike-off through Form 24 is the preferred method for inactive LLPs. It is quicker, more economical, and at the same time, it satisfies the main objective of freeing the partners from compliance obligations.

Process

Process of Limited Liability Partnership (LLP) Closure

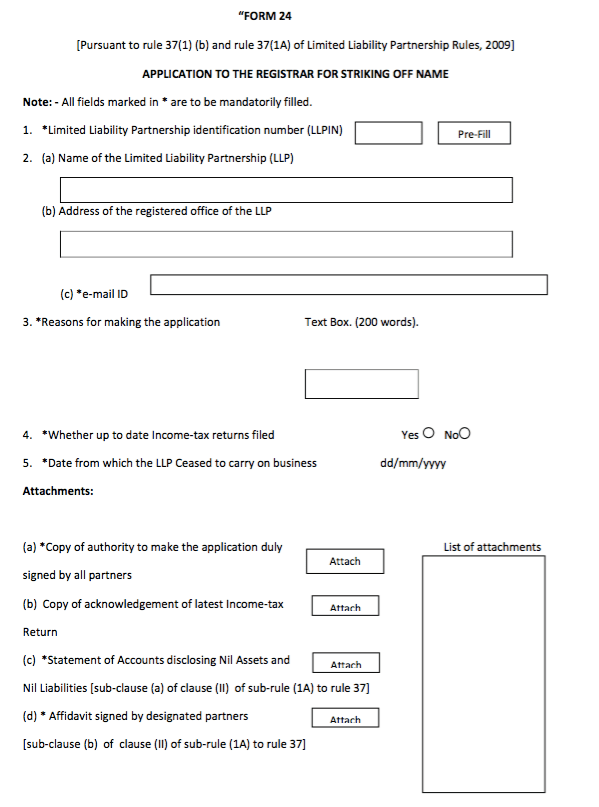

When partners decide to close a Limited Liability Partnership (LLP), they must follow a specific legal procedure. This includes submitting an online application (e-Form 24) to the Registrar of Companies (ROC).

✅ Step 1: Obtain Partner Consent

Before closing the LLP, ensure all partners consent to the closure process.

✅ Step 2: Cease Business Operations

The LLP must halt all commercial activities and stop accepting orders. Note that the business should have ceased operations for at least two financial years before applying for closure.

✅ Step 3: Close Business Bank Accounts

Partners should close all business bank accounts by submitting a formal application to the bank manager.

✅ Step 4: Submit Affidavits and Declarations

Each designated partner must submit an affidavit stating the LLP has no active operations, commercial activities, dues, or liabilities. Consider consulting a professional for proper documentation.

✅ Step 5: Prepare Documentation

Partners need to provide Income Tax Return (ITR) statements, if applicable. If the LLP did not start operations, ITR statements may not be necessary.

✅ Step 6: Finalize Financial Records

Ensure that all LLP accounting records are accurate and up-to-date. A statement of assets and liabilities, certified by a practising CA, must be submitted and should not be older than 30 days.

✅ Step 7: File Form 24

Submit a resolution to the ROC with e-Form 24, declaring that the LLP has no outstanding debts. Attach required affidavits with this submission.

✅ Step 8: Striking Off the LLP]

Once the ROC verifies the documents, they will strike-off the LLP from the register, officially closing it.

Required Documents

Documents Required for Winding Up a Limited Liability Partnership (LLP)

To initiate the winding up of an LLP, applicants must gather and submit a specific set of documents.

Here’s the complete checklist-

1. Detailed Closure Application

Submit a comprehensive application for the closure of the LLP, detailing the intent and reasons for winding up.

2. Affidavit of No Liabilities

Provide an affidavit signed by all partners, declaring that the LLP has no outstanding liabilities or dues.

3. Partner Consent

Ensure all partners provide written consent, agreeing to the LLP closure.

4. Statement of Assets and Liabilities

Submit a certified statement of assets and liabilities, verified by a Chartered Accountant (CA), that is no older than 30 days.

5. Income Tax Return (ITR) Statements

Include the latest ITR statements to confirm the LLP’s financial status. If the LLP has not conducted any business, ITR statements may not be required.

6. e-Form 24 with Indemnity Bond

File e-Form 24 along with an Indemnity Bond to the Registrar of Companies (ROC) as part of the official closure process

Users are Required to Adhere to the Following Formatting Requirements:

- PDF format is the only acceptable format for all documents

- Affidavits and declarations should be notarised properly

- Only original (scanned) or digital signatures are accepted

- Document size limit should be within the MCA portal limits

- File names have to be clear and descriptive

Timeline

Timeline of LLP Company Closure in India

The costs and the realistic timeline of the closure process of your LLP give a forecast to you that is better. These numbers come from real industry practices, as they will be in 2026

Timeline for LLP Closure

|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actual Timeline Example: Closure can be expected by the end of March or early April if the process is initiated on January 1 with all documents prepared.

There are various causes for delays:

- If any required document is lacking

- If the closure certificate from the bank is not yet obtained

- If ITR has not been filed for the past few years

- If the CA certificate is older than 30 days

- If any partner's DSC is expired or not registered

- If the ROC has some questions regarding a discrepancy

- If there are any public objections raised

Why Choose JustStart?

Why Choose JustStart for LLP Company Closure?

Easy & Hassle-Free Process

If your LLP has been inactive for over a year with no business activities, JustStart makes the closure process straightforward and stress-free.

Minimal Compliance Requirements

Inactive LLPs are still subject to specific compliance regulations. By choosing JustStart for LLP closing, you can eliminate these obligations and focus on future ventures without the administrative burden.

Strategic Execution

Our team handles every step, from planning to execution, ensuring each stage of the LLP closure process is thoroughly and efficiently managed according to industry benchmarks.

Driven by Commitment and Expertise

At JustStart, we are dedicated to supporting visionaries who aim to achieve great things. With our commitment and expertise, we ensure a smooth, hassle-free LLP closing experience.

Deadline-Oriented Service

Time is valuable, and we take it seriously. We implement strict measures to ensure that your LLP closure process adheres to all critical deadlines.

Quality Assurance and Client Satisfaction

JustStart prioritizes quality at every level. We systematically review our processes to minimize errors, ensuring each task is completed to our high standards and meets your expectations.

Locations

LLP Closure in Other States and Cities

FAQs

LET'S CLEAR ALL THE DOUBTS!

As per legal experts, a business can shut down its operations in the following two ways:

- Declaring a company insolvent

- Closing down business operations

No. One year should have passed where the LLP has not done any business since its formation before its dissolution.

No. First, the business operations of the LLP should be ceased and at least a period of two years should have been passed before filing its closure application.

No. The law typically requires the firm to first close all the accounts and clear all the liabilities before they can be listed for closure. Only after receiving a final statement, can company partners apply to strike off the LLP’s name from the registrar.

ROC is a Government office with whom companies get registered. Every State has one ROC office except some states.

No. Filing form 24 is mandatory to close a limited liability partnership firm.

The cost of closing an LLP in India may vary from region to region and depend on the services hired by the applicants. If you hire an expert and professional services, you can easily find their services within an affordable budget of Rs. 6000-10,000. However, it is always suggested to gather complete details to avoid paying any hidden charges.

Given all the documents are prepared accurately and the applicants have hired professional legal help, you can expect to complete the procedure within 15–30 days. In cases of delay, the process may stretch up to two months or more. Therefore, it is best to opt to hire a dedicated team assistant like JustStart.

Some of the steps, like obtaining affidavits and filing form 24, and require extreme care. Thus, the process can be complex if you have a lack of experience in the legal field.

If a business chooses not to close an LLP even after one year of business inactivity, the law holds them subject to paying a penalty.