Get simple and easy steps to register for startup in India along with in-depth details like eligibility, benefits and procedures.

Are you desperate to know how to register your startup in India? In this blog, you can find answers to your queries in the easiest way possible. But before proceeding further, you should understand the concept of startup and types of startup companies in India. If you are wondering about the process of Startup Scheme Registration.

Table of Contents

ToggleWhat Is A Startup Company?

According to the Ministry of Commerce and Industry, a Startup is an organization that works towards innovation, development or commercialization of products or services driven by technology, IPR or patents. However, the annual turnover should not exceed a maximum of Rs 100 crore in any preceding year.

The purpose of Startup companies is to contribute to the development of existing systems. Apart from this, every startup has a different perspective on scaling.

Startup India registration offers various benefits to organizations. The Government of India has launched several startup schemes aimed at encouraging self-employment.

Procedure For Registering A Startup In India

The procedures for registering a startup in India are as follows:

- Incorporate your business:

To register under the Startup India Scheme, first, you need to incorporate a private limited company, a limited liability partnership, or a One Person Company.

You will have to follow the normal procedure to register the business and obtain the incorporation certificate for the company. Then you have to register yourself under Startup India Scheme.

- Visit the website: https://www.nsws.gov.in/. Visit the website of the National Single Window System.

- Creation of a login I’d: Create the login ID with the company’s email, and set the password according to your choice. Confirm all the details and verify them.

- Prepare the organization. Digital Signature: The digital signature of the organization is mandatory for the Startup India Scheme. For the digital signature, authorization letter, and company’s incorporation certificate, a PAN card and Aadhar card of the authorized person are required.

- Prepare and collect all the documents: Incorporation certificate, signed authorization letter, entity logo, and any other optional documents like MSME certificate, Gst certificate, trademark registration, and any award recognition certificate that have been attached to the form.

- Fill out the Application Form: Fill out the form by giving all the details about the business, including how your startup is unique, wealth creation , employment generation, and the problem you are solving for the country.

- Submit the application. The last step is to submit the application with all the required details and get the DPIIT recognition certificate.

Follow the above steps and get the Startup India Recognition Certificate.

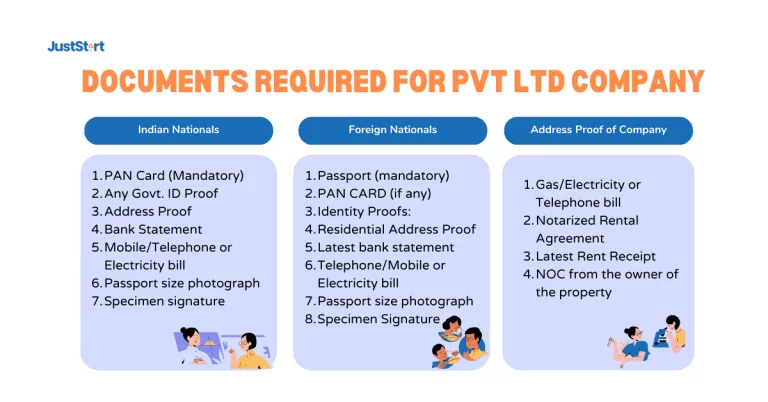

Documents Required For Startup India Registration

For Startup India registration, the following documents are required:

- Digital signature of the organization.

- Incorporation certificate,

- Signed authorization letter for filling out the application.

- Entity logo (whether registered or not)

- Any other optional documents, like the MSME certificate, GST certificate, trademark registration, and any award recognition certificate.

What Is The Benefit Of Startup Registration?

While Startup India registration is a profitable option for legal purposes, choose to complete. Startup company registration is a smart way to take your business up a notch. Let’s see how

- Business Gets a Separate Legal Stature : The business you register will be considered a legal entity, and your company will be able to buy and sell more land on its behalf, conduct operations throughout India, and make calculated decisions to increase profits.

- Financing Help by Government Schemes: The government of India is determined to provide multiple platforms for young entrepreneurs to grow, explore new opportunities, and expand the economy.

- Help From Banks: Startup India registration also enables you to carry out personal activities like obtaining a loan for business use. If you have a registered address and proof of the company, the banks will easily commission a loan in your favor.

- Tax Exemptions: A startup which is recognized enjoys income tax exemption for three consecutive financial years out of their first ten years since incorporation.

Now that you know about the benefits of registering a startup, let’s look at the startup registration process.

How Many Days It will take after the startup Registration?

After submitting the application, if no query is raised, you will get a startup registration certificate within a single day.

Faqs

How long does startup registration take?

Startup registration only takes a single day if we have all the documents and details regarding the entity with us.

What Are The Rules For Startups In India?

There are only three mandatory rules for startups in India. To get registration under this one, you will have to register as an

- entities like a private limited company, a limited liability company, or a one-person company.

- Organisational digital signatures are required.

- Company’s logo, whether registered or not.

Who Is Eligible For The Startup India Scheme?

Private limited companies, limited liability partnerships, registered partnership firms and one person companies are eligible for the Startup India Scheme.