Private companies are small, closed companies that are specifically made for small businesses. For example, an accountant, a lawyer, etc. The owners of this are called the shareholders of the company.

While there are many other companies situated like private companies or sole proprietorships, registering as a private company has its own advantages. in this, we will study the step-by-step process to register for a private company online and how it works in India,

Table of Contents

ToggleSignificant Points to Remember

- No minimum paid-up capital requirement.

- Minimum number of members-2 [Except if the company is an OPC]

- Right to transfer the shares.

- Maximum number of members-200, excluding present employee cum members.

- Prohibition on an invitation to subscribe to securities of the company.

Types of Private Companies

1. Company Limited By Shares

Section 2 [22] of the Companies Act, 2013 defines that when the liability of the members of a company is limited by its memorandum of association [MOA] to the amount unpaid on the shares held by them it is known as a company limited by shares.

Thus, it implies that for meeting the debts of the company, the shareholder may be called upon to contribute only to the extent of the amount which remains unpaid on his shareholdings.

While a shareholder can be the co-owner of the company, he is not the owner of the company’s assets. the ownership of the assets will remain to the company because of its nature as a legal person.

2. Company Limited by Guarantee

Section 2[21] of the Companies Act, 2013 defines it as a company having the liability of its members limited by the memorandum to such amount that the members may respectively undertake by the memorandum to contribute to the assets of the company.

Thus, the liability of a member of a guarantee company is limited up to a sum mentioned in the memorandum. members cannot be called upon to contribute beyond the stipulated sum.

This company is only useful when there is no need for the working funds or these funds can be held from other resources like fees, donations, charges, etc.

3. Unlimited Company

Section 2[92] of the Companies Act, 2013 defines an unlimited company as a company not having any limit on the liability of its members. In this, the liability of a member ceases when he ceases to be a member.

The liability of each member of this company extends to the whole amount of the company’s debts and liability but he will be entitled to claim this contribution from the other members.

In case the company has a share capital, the Article of Association [AOA] must state the amount of share capital and the amount of each share.

Registration Process

Step 1- DSC

Digital Signature Certificates are important while you register for the online process in India. It is required to fill the forms on the MCA portal. It is acquired to prove one’s identity and to access all the services over the internet. You can apply it from mca.gov.in for fast results.

Step 2- DIN

Director Identification Number is a unique direct identification number allotted by the central government to any person intending to be a director or an existing director of the company. It is mandatory for any type of communication with the Income Tax Department. You can apply it from mca.gov.in to start your application process.

Step 3- Apply for the Name Availability

A company name has immense power to assure the quality of your brand or to set customer expectations. It represents your brand in a unique and subtle way so it is important to take time and effort in naming your company. Once done, you can check the name availability on MCA.

Step 4- Submission of AOA and MOA

The next important step is to submit a Memorandum of Association [MOA] and Articles of Association [AOA]. It defines your company’s scope of work and its internal management.

Step 5- Apply for PAN and TAN of the Company

While TAN is a number allocated to tax deductors, PAN or permanent account number is allotted to the taxpayers. PAN is a ten-digit number that is mandatory by the income tax department.

Step 6- Certificate of Incorporation

RJSC will issue a certificate of incorporation of the company. This certificate will have the registration number, name of the company, and date of incorporation.

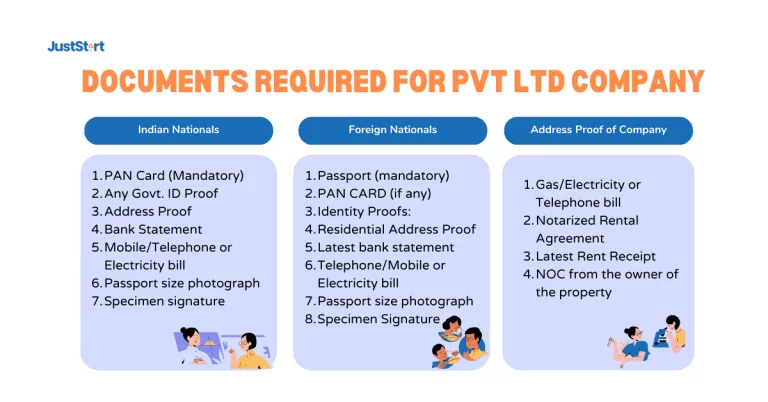

Documents Required

- PAN Card

- Aadhar Card

- Passport Size Photograph

- Voter ID/Passport

- Telephone Electricity Bill/Bank Account Statement

Characteristics

- According to the amendment in 2015, private companies can only have a minimum paid up share capital of one lakh. It can have the capital of any amount because now the amendment is removed.

- All the private companies must include ‘Private limited’ or ‘Pvt. Ltd’ in their names.

- A company holds perpetual succession that is a company will continue to survive until it dissolves legally.

- A private company must have at least two board of directors.

- The legal formalities in a private company are less as compared to a public company.

Advantages

- The company will have a separate legal entity distinct from its members.

- The members are only responsible for a limited amount of debts for the company.

- A company can acquire or own the property in its own name.

- The company can sue and also be sued by the other company.

- It is easy to fetch funding through the transfer of shares.

Disadvantages

- The number of members cannot exceed 200.

- A private company cannot raise shares for its own company. Therefore, it can create limitations to the growth of the company.

- They are more difficult and expensive to incorporate than a sole proprietorship.

- The shares cannot be offered to the public and cannot be listed on the stock exchange.

- The number of shareholders cannot exceed 50.