Starting a business in India can be a complex and time-consuming process, but it is necessary to establish a successful venture.

However, before starting your business, you need to understand the legal procedures for the business registration of your startup in India. This blog will discuss the general legal strategies required to start a small business in India and some advice for business startups in India on when you should seek professional legal help.

Choose the most appropriate type of business structure that meets your needs to legally register your startup.

Table of Contents

ToggleTypes of business entities in India

- Sole Proprietorship

- Partnership Firm

- Limited Liability Partnership

- Private Limited Company

- Public Limited Company

- One Person Company

Sole proprietorship and partnership firms have unlimited liability, no separate legal personality from their owners or partners, less compliance, and lower registration costs than other business structures.

On the other hand, LLP, OPC, private and public companies have limited liability and are recognized as separate legal entities; This will make it easier to raise funds from investors. However, OPC is not allowed to raise funds from any investor.

Businesses also need to obtain Shop and Establishment Act registration, municipal or civic body permission, electricity and water connection, and other specific licenses, such as GST registration, FSSAI license, trade license, etc., depending on the nature of their business.

Each type has its own advantages and disadvantages, so it’s important to research each option carefully before making a decision.

Legal requirements and Formalities to be fulfilled by a startup in India

Depending on the type of business you’re starting and where you’re located, different laws and regulations may apply to your situation. Here is an essential legal guide that will help you understand what is involved in setting up a new business:

1. Choose a Business Structure

To start your business, the first step is to research the process and ask yourself some critical questions. Questions such as:

- What are my objectives for this business venture?

- What products or services am I offering?

- Do I intend to employ others, or do I plan to work alone?

- What financial resources do I need and have available?

Gathering this information will help guide you through the process. The most common business structures include sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Each system has different tax implications and legal protections for owners. For help deciding which structure is best suited for your situation, you may want to consult one of JustStart’s experts.

2. Obtain Necessary Licenses and Permits

Depending on your location, industry, or the type of services your business provides, you may need to obtain specific licenses or permits from local or state authorities before beginning operations. Research these requirements to ensure compliance from day one of your new venture.

3. Draft Legal Documents

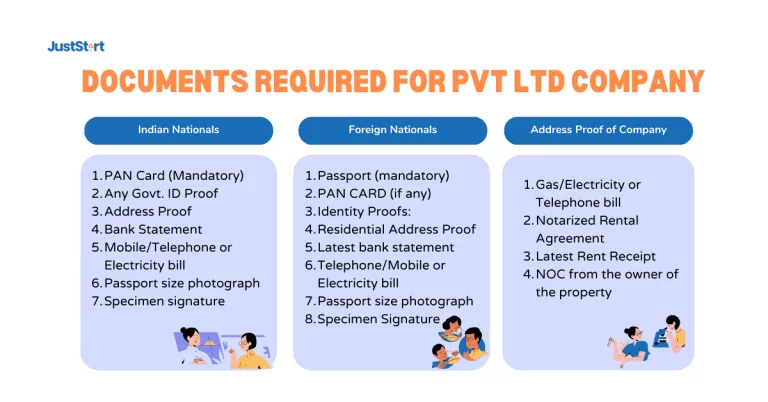

Depending on the type of business structure chosen for your company, certain documents may need to be drafted, such as Articles of associations or Memorandum of associations (for Pvt Ltd Company) or Partnership Agreements (for LLPs). These documents outline ownership rights and responsibilities as well as other essential details regarding management and financial control over the company’s activities and assets.

4. File Required Forms with Government Agencies

Once you have established the necessary legal documents and obtained the necessary licenses/permits to operate in your state/locality, apply for an MCA or file some forms with the applicable government agencies like ROC.

5. Get Ready to Pay State and Local Taxes

It is important to know the different state and local taxes that may apply to your business. For example, depending on where you live, you may owe sales tax, personal property tax, or use tax. Additionally, your business operates out of multiple states or territories. In that case, you may need to register for additional state and local taxes to pay taxes in those jurisdictions.

6. Comply With Other Laws/Regulations

In addition to obtaining necessary licenses/permits and filing required forms with government agencies before beginning operations, businesses must comply with certain other laws and regulations depending on their industry sector, such as labor laws related to employees’ rights and Safety rules regarding products sold/manufactured, etc. Research these requirements thoroughly before starting so that all aspects of running a successful company are addressed correctly from day one!

7. Developing an Effective Business Policy

Establishing an effective business strategy is important to help any business succeed. It focuses on both employees and management, assisting the venture achieve its desired goals and objectives.

8. Choose the Right Business Insurance for Your Needs

When choosing business insurance for your enterprise, it is essential to consider the size and scope of your operations and any specific risks associated with it. Research different providers and compare their coverage options and prices to find the best one. With the right policy you can protect your business from potential risks and liabilities.

Overall, startups in India need to be careful in dealing with legal matters as lack of understanding of the laws governing their business can land them in serious trouble if not handled properly in the initial stage.

Conclusion

In conclusion, starting a business in India it is necessary to register the company with the Registrar of Companies and obtain licenses from the relevant authorities. It is also important to open a corporate bank account and accept tax registrations like GST, Income Tax, Professional Tax etc. All these procedures are essential for setting up a successful startup in India and should be followed diligently. Finally, it is essential to register your startup legally in India to ensure that all local laws and regulations are followed.