Introduction to Company Identification in India

Company registration/identification in India means registering the company with the Ministry of Corporate Affairs through a formal legal process. This process allows a business to be a separate legal entity within the framework of the Companies Act,2013.

The key aspect of registering a company in India is getting a unique ID for the company. A unique ID is a corporate identification Number, a 21-digit number issued to track the company’s activities and legal compliance.

Understanding the Corporate Identification Number (CIN)

CIN is a 21-digit alphanumeric corporate identification number given to a company when it is incorporated by the Registrar of Companies of each state under the Ministry of Corporate Affairs (MCA).

CIN is given to all types of companies registered with the MCA, Like Private limited companies, public limited companies, one-person companies, and Section 8 NGO companies.

CIN is not assigned to the Limited Liability Partnerships(LLP) registered in India. For the registered LLP, the ROC is given a 7-digit code that is called Limited Liability Partnership Identification Number (LLPIN)

Why is CIN Crucial for Business Identity and Compliance?

The Corporate Identification Number (CIN) is crucial for business identity and Compliance as it is a unique identifier for the company. CIN distinguishes each company's legal status and is easily identifiable for the company in India. CIN is not just a number; it’s a company's legal footprint.

The Corporate Identification Number (CIN) is a 21-digit alphanumeric number assigned by the Registrar of Companies (ROC) in India to every company that is registered in India under the MCA as per the Companies Act,2013. CIN plays a crucial role in legal compliance, identity verification, and administrative tracking. Here is why it is important:

Legal Compliance:

- A corporate Identification Number (CIN) is mandatory for filing the ROC compliances like the annual Balance sheet, Annual return, and other documents submitted to the Ministry of Corporate Affairs (MCA).

- CIN is mandatory to be mentioned on the company’s documents like invoices, letterheads, and other legal documents, as under section 12(3)(c ) of the Companies Act.

- It regulates that the business is legally registered under the Companies Act,2013.

Identity verification for Business:

- CIN acts as a unique ID for the companies, just like for an Individual, a PAN matters.

- Banks, investors, and government bodies can verify the company’s legal presence by using the CIN number of the company.

- The CIN structure reveals the listing status, state of registration, industry code, incorporation date, and registration.

Administrative Tracking:

- CIN helps government bodies track compliance history, legal status, and financial disclosures.

- CIN enables data analytics for policymakers to assess business trends and the most likely risks.

- Efficient record-keeping and inspection of companies across India.

Therefore, CIN is like an ID card for the company. It proves that the companies are legally registered and regulated under the Companies Act,2013.

Key Abbreviations and Their Meaning in a CIN

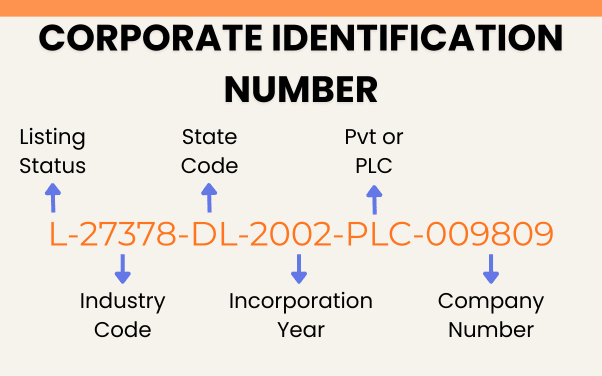

Breakdown of the CIN Format: What Each Section Represents

CIN is a 21-character alphanumeric code, and each part signifies a meaning that reveals information about the company.

Let’s discuss through an example: U12345DL2025PTC123456

- The first Character” U” represents the status of the listing:

L- Listed Company

U- Unlisted Company

- The Next Five characters “12345” denote the Industry Code:

Industry code basically means the business is in the IT Sector, manufacturing sector, etc, as per the NIC (National Industry Classification) Codes.

- The Next TWO characters, “ DL “, represent the state Code:

The state code means the company is registered in Delhi state.

More examples:

TN - Tamil Nadu

MH- Maharashtra

UP- Uttar Pradesh

WB-West Bengal

RJ- Rajasthan

KA- Karnataka

- The Next FOUR Digits,”2025”, connotes the year of Incorporation

The next four digits, 2025, state that the company was incorporated in the year 2025 with the Registrar of Companies.

- The Next Three characters are “PTC”, Type of Company

The next three characters tell that the company is

PTC- Private limited company,

PLC - public limited company,

NPC- Non-profit company,

OPC- one-person company,

FTC- Subsidiary of a foreign company.

GAP- Guarantee and association company.

SGC- Company owned by the State government

GOI- Company owned by the Government of India

ULL- Unlimited Liability Company

- The next SIX Digits are the Registration number “123456”

The last 6-digit number is the unique registration number of the company given by the Registrar of Companies.

Step-by-Step Process: How to Get a CIN Number

CIN is auto-generated during company incorporation when a company is registered under the Ministry of Corporate Affairs. Here is a step-by-step process to get a CIN number:

Step 1 - Choose the type of Company structure

Choose which type of Company structure you want to register with:

PTC- Private limited company,

PLC - public limited company,

NPC- Non-profit company,

OPC- one-person company,

FTC- Subsidiary of a foreign company.

GAP- Guarantee and association company.

SGC- Company owned by the State government

GOI- Company owned by the Government of India

ULL- Unlimited Liability Company

Step 2- Apply the Digital Signature

After deciding the type of entity, apply for the digital signature of the proposed directors.

Step 3- Apply for DIN (Director Identification Number )

Need to apply for a DIN (Director Identification Number) for each proposed director, as it is the unique identification number for the director.

Step 4- Reserve a company name

Choose a unique name and apply for the name reservation through Part A of the SPICe+ form.

Step 5- Incorporation forms

After reserving the name, fill out the form Part B of the SPICEe+ form, which covers company details like paid-up capital, authorized capital, address details, and the director's details.

Step 6- Upload the documents

Attached are the required documents in the form. They are;

- Identity proof of the directors

- Registered address proof of the company

- Address proof of the directors

- Memorandum of Articles and Articles of Association (E- Moa & Aoa)

Step 7- Pay the fees and submit the forms

Pay the requisite fees and submit the forms through the MCA Portal.

Step 8- Incorporation Certificate/PAN & TAN of the Company

After submitting the forms through the MCA portal, you will receive a certificate of incorporation, PAN & TAN of the Company. The Certificate comes which contains the CIN number of the Company.

In summary, in the above manner, CIN is auto-generated during company incorporation via the MCA portal when it is successfully registered.

How and Where is the CIN Number Used?

The Corporate Identification Number (CIN) is an official number for a company registered in India. CIN is legally required in several places to ensure transparency and traceability in the business world.

- CIN is officially required on the documents printed for the company, like letterhead, invoices, billing notices, official emails, company brochures, and websites.

- CIN is required in government and statutory forms filing as ROC filing forms, GST filing forms, tax filings, IEC registration, and PF & ESI compliances.

In summary, CIN is the official ID for the company and is mandatory to be displayed in the areas mentioned above.

How to Change a CIN Number? Conditions and Process

A CIN number is subject to change only when there is a modification in certain core details of the company, Such as

-

Changes in the Registered Office

The 7th and 8th characters in the Company identification number indicate the state code (e.g., MH for Maharashtra, DL for Delhi). If you relocate your registered office from one state to another (for Example, from Maharashtra to Gujarat), your CIN will be updated with the new state code.

-

Changes in Company Type

The 14th to 16th characters in the CIN reflect the company classification:

PTC = Private Limited

PLC = Public Limited

OPC = One Person Company

If you convert your company type, the CIN changes to reflect the new structure. For example, converting an OPC to a Private Limited, etc.

Process to Change or Update your CIN

The CIN is automatically updated by the Ministry of Corporate Affairs (MCA) whenever any relevant changes are legally made and approved.

A. For Change of Registered Office to Another State

- Pass Board Resolution and Special Resolution for shifting the office.

- File Form MGT-14 with the MCA Portal.

- File Form INC-23 for approval from the Regional Director.

- After approval, file INC-28 and INC-22 to update RoC records.

- Your new CIN is auto-generated with the updated state code

B. For Change in Company Type

- Hold necessary Board and Member resolutions.

- File Form MGT-14 and INC-27 (conversion form) with supporting documents.

Once approved, the Registrar of Companies issues a new Certificate of Incorporation with a new CIN.

Difference Between CIN, LLPIN, and GSTIN

Here is a clear comparison table showing the difference between CIN, LLPIN, and GSTIN-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Penalties for Non-Compliance (Not Displaying CIN) in 2025

Under the Companies Act,2013, every company that is registered in India is legally required to mention the CIN in specific places. Failure will lead to monetary penalties in such cases mentioned below:

- Legal provisions under section 13(3)(c ) of the Companies Act,2013, CIN mandates to be printed on the company's letterheads, invoices, official emails, brochures, notices, bills, and the company’s website.

- If the company fails to display the CIN Number, then the penalty will be imposed on the company and each officer in default (company secretary, directors ), and the amount of the penalty will also be 1000 per day and a maximum of up to 100000.

To avoid penalties, all companies must display the CIN number on the board, the office address, and all their stationery and invoices.

Conclusion

In conclusion, the proper maintenance and display of your CIN not only ensures that your business is compliant with the law but also confers trust and credibility among investors, clients, and the government. Juststart will take care of all the legal aspects and help you get a valid CIN number through registering your company.

Frequently Asked Questions (FAQs)

1. How can I get my CIN number?

The MCA portal allows you to look up the company name, and there you can find your CIN number under "Find CIN" or "View Company Master Data" section.

2. What does CIN number serve for?

CIN is the sole identifier of a registered company in India and is necessary for all ROC filings, compliance, and official documents.

3. Are CIN and PAN numbers identical?

No, CIN is an identifier assigned by MCA for a company, while PAN is a tax identification number given by the Income Tax Department.

4. Who gets a CIN number?

Entities that are registered as per the Companies Act, 2013, such as Private Limited, Public Limited, or One Person Company, can get a CIN number.

5. Is it a requirement to put the CIN on company documents?

Yes, according to the MCA guidelines, it is required to put the CIN on company letterheads, invoices, notices, bills and other official documents. Non-compliance may result in a penalty under the Companies Act.

6. Can the CIN number change?

Yes, the CIN number can change if the company moves its registered office to another state, changes its listing status or alters its business activity. However, the registration number of the company that is part of CIN usually stays the same.

7. Are CIN and GST numbers the same?

No, they are not the same at all. A company gets a CIN (Corporate Identification Number) once it is registered with the Ministry of Corporate Affairs, on the other hand, a GSTIN (Goods and Services Tax Identification Number) is given for tax registration under the GST Act.

8. Who provides the CIN number in India?

After the company registration process is complete, the ROC (Registrar of Companies) issues the CIN number. This number serves as the official identification number of every registered company in India.