COMPANIES ACT

Companies Act 2013 Overview

The Companies Act 2013 is the main law that was enacted by the Indian parliament, which governs how companies are formed and run in India. It replaced the old Companies Act 1956. To replace this 1956 act makes rules simpler, modern and more transparent. The Companies Act 2013 plays a big significant role in company registration, making the process uniform and simpler across the country.

This Act mandates that all companies, private, public or one person, must register under its provisions, ensuring proper legal recognition and accountability. It introduced key features like digital filing, the spice+ (Simplified Proforma for Incorporating Company electronically Plus) form, for quick online registration and one stop portal for getting all mandatory approvals faster and efficiently.

These digital steps offer a standardized approach across all states. Following the act is important as it keeps the company safe and legally avoids penalties. Compliance under the Companies Act 2013 is not just a legal formality but a protection against the penalties and operational hurdles, which help them grow with confidence in India’s business environment.

OVERVIEW

What is Company Registration?

Company Registration means officially forming a company or business entity under the law. In India, this process is basically governed by the Companies Act, 2013 and regulated by the MCA, i.e., The Ministry of Corporate Affairs. Registration gives the company a separate legal entity,

In India, forming a company is mandatory if you want to operate a private limited company, a public limited company, one person company, or any other recognized business structure. By doing this, it ensures that your business follows the rules under the Companies Act 2013.

Having a registered company builds credibility with customers, partners and investors. It also makes your business eligible for funding and protecting your brand value.

JustStart simplifies the registration process with expert guidance, digital filing and all legal compliance -helping you grow your business without any legal hassle.

Business Structures

Business Structure Comparison Table

When starting a company, choosing the right business structure is one of the crucial first steps, according to your size and investment in your business. Use the comparison table below to understand in which business structure your business/entity falls:-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STRUCTURES

Company Structures in India

Choosing the right company structure is important for your growth plans and business success. Here’s a simple explanation of the main types of company structures in India.

Each business structure has unique benefits- choose one that aligns with your vision, size and compliance requirements.

Private Limited Company (Pvt Ltd)

Pvt Ltd Company is the best structure for startups and even small to medium enterprises. It offers limited liability, a separate legal identity, and attracts investors. It is trusted and widely used.

Limited Liability Partnership (LLP)

Limited Liability Company is great for small businesses or professionals who want to start a business with their partner, as it combines the benefits of a partnership and a company. It offers flexibility in management, and partners enjoy limited liability with fewer compliances.

Section 8 Company (NGO)

A Section 8 company is designed for a non-profit organisation and a social enterprise. These companies don’t focus on profits and get many tax benefits for doing work for society.

Public Limited Company (LTD)

A Public limited company is ideal for large businesses that want to raise money from the public or list on the stock market. It attracts public investment.

Producer Company (FPO)

Farmer producer company is ideal for farmers or people involved in agriculture. It helps the members work together in farming, production, processing and marketing. Offers better market access and profit sharing.

One Person Company(OPC)

One person company is perfect for solo individuals who want to run a company with full control while enjoying limited liability. It offers the benefits of a private limited company without needing partners.

Documents Required

Documents Required for Company Registration Online

In India, registering a company means submitting the correct documents is mandatory. Mistakes or missing paperwork will lead to rejection and delays. Here’s a list of documents required for company registration online:

Documents Needed for Indian Directors/ Shareholders

- PAN Card: Mandatory for identity verification

- Aadhaar: Required for KYC and digital verification

- Address proof: Address proof like voter ID card, driving license or passport, bank statement

- Photographs: Recent passport-size photo with clear background.

- Utility bill( Business Address proof ): Latest electricity bill, water or gas bill of the premises ( not older than 2 months)

- NOC from property owner: If the premises are on rent, then the rent agreement or the NOC from the owner is required.

- MOA: Memorandum of Association describes the business objects.

- AOA: Article of Association describes how the company will operate internally.

Documents Required for Foreign Nationals:

- Passport - Valid, notarised & apostilled

- Address Proof: Notarised & apostilled

Common Mistakes to Avoid:

- Cross-verify the documents while submitting the forms, like spelling mismatches in the PAN card or the Aadhar card.

- Using an old utility bill.

- Uploading unsigned documents

- Submitting foreign documents ( Notarised & Apostilled)

Getting your right documents from the start saves your time and prevents unnecessary hassle. At justStart, we help you review and organize all paperwork for smooth functioning and error-free company registration.

Benefits

Benefits of Company Registration in India

Registering a company has many benefits in terms of limited liability, investment, funding, etc. Here are the benefits of online company registration in India:-

Legal Recognition:

A registered company has a legal recognition. It can sign contracts, get funding, and apply for government tenders.

For Example, A software developer started as a freelancer. After registering the company, he can sign contracts with big IT companies.

Limited liability Protection:

If the company faces any legal problem, the director’s/partner’s personal money and property are safe.

For Example: If your business loses money, your personal assets like a car, houses won’t be taken to pay the company’s debt.

Foreign Investment:

Foreign investments are made easier when the person has a registered company, as the investment from the foreign investors under the automatic route can be taken, especially for private limited companies.

For Example: A Bangalore based app development company got seed funding from a US investor after registering as a Private Ltd Company.

Brand Protection:

Once your company is registered, no one else can legally use the name or a similar name to register a company with a similar name. It can protect your brand name and legal identity.

For Example: Oh My Vegan protects their brand by copying from other brands by registering it with MCA.

Perpetual Succession:

A company which is registered keeps running if the owner leaves, retires or passes away. It means it never ends. It has a perpetual succession.

For Example: ABC is a private limited company. There are 2 directors in an ABC Private company. Director 2 left the company due to some personal issues. So, the company continues by appointing another director in an ABC Private Limited Company.

Tax Benefits:

Pay less, Save more: A registered company in India has many special tax deductions, rebates and lower tax rates in terms of unregistered companies.

For Example: a Private Limited Company, A startup registered in Mumbai, earned ₹35 lakhs profit. Because it was a DPIIT-recognized startup under Startup India, it claimed the 3-year tax holiday and paid zero income tax in the first 3 years.

So, above are the benefits of company registration in India.

Eligibility

Eligibility Criteria for Company Registration in India

Before registering a company, it is very important to know the Eligibility criteria for company Registration and what are the requirements must be met:

✅ Minimum Age:

Directors must be at least 18 years in age, and there is no maximum age limit for registering a company in India.

✅ Nationality:

Indian citizens, Non-resident Indians, and Foreign Nationals can register a company in India. In case of foreign nationals must provide a valid passport and address proof.

✅ Minimum directors/members for each structure:

- Depending on the business structure, the minimum number of directors varies. They are :

- Private Limited company: Minimum 2 directors, 2 shareholders

- Public limited company: Minimum 3 directors, 7 shareholders

- One-person Company: Minimum 1 director, 1 shareholder

- Limited Liability Partnership (LLP): Minimum 2 Designated partners

✅ Restrictions for undischarged insolvents or persons convicted of fraud:

- Persons who are involved in any illegal activity.

- People who haven’t cleared bankruptcy

- Persons conducted any fraud or code of misconduct in the last 5 years

- Disqualified by a court or any government regulatory body.

Process

Online Company Registration Process in India

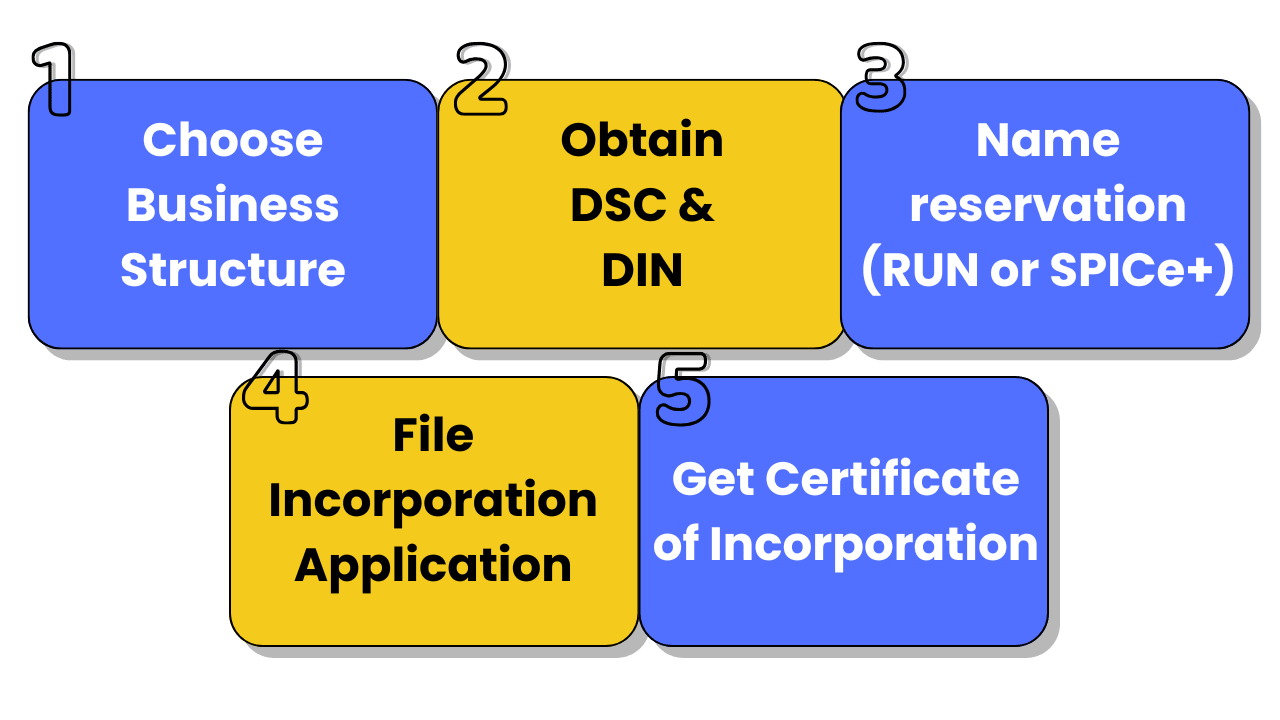

Starting a company registration in India involves following the legal steps. Here, it is:

Step 1: Choose the Right Business Structure

Before starting with the process, firstly choose the right business structure, such as a private limited company, one person company(OPC), limited liability partnership(LLP), or public limited company(PLC). Your choice for business structure will affect your tax liability, compliance, fundraising ability and ownership flexibility. Choose wisely.

Step 2: Obtain DSC & DIN

Firstly, obtain the Digital Signature (DSC) and Director Identification Number (DIN) of the proposed directors/partners. It is one of the mandatory steps in the company registration in India.

Step 3: Name reservation (RUN or SPICe+)

Secondly, choose a unique name for your company and fill a form for name reservation. It should not be similar to the existing companies and registered trademarks.

Step 4: Prepare MOA & AOA

Prepare a MOA (Memorandum of Association) explaining the business activities of the company, and AOA (Articles of Association) that defines the company's rules and structure.

Step 5: File Incorporation Application

The next step is to prepare the spice+ forms after preparing all the above documents with all the attachments required for filling the forms.

Step 6: Get Certificate of Incorporation, PAN, TAN

After submitting the form, if all the forms are approved by the ROC, then we will get the certificate of Incorporation, PAN and TAN of the company.

Step 7: Apply for GST( Goods & Services Tax)

It is optional to get the GST registration number. If your turnover exceeds Rs. 20 lakhs for service providers and for goods it exceeds Rs. 40 lakhs, then it will be mandatory to get the registration certificate.

With JustStart, you do not need to worry about the paperwork or procedures; every single step will be handled by the team of experts, so you can just focus on growing your business.

Name Reservation

Business Name Reservation

Choosing your business name is the first and most important step in the company registration process. It should be a unique name not resembling any existing companies and registered trademarks, general names, or contain any restricted words. This helps you to build your brand identity and avoid legal issues.

There are 2 ways to reserve the name on the MCA:

RUN ( Reserve unique name ) - Run is the form when you choose to reserve your name first and then start the process. Or SPICE+ - you are ready to register the company along with the name.

Here are some simple Tips for name approval under MCA rules

- Ensure Uniqueness: Keep it simple and unique to free from any hassle with the name.

- Avoid restricted names: Don’t take general names or any restricted names like Bank, insurance, stock exchange, mutual funds, etc, which require special approvals.

- Use a proper suffix: Add a proper suffix after your company based on the business type, like private limited company, limited liability partnership (LLP), OPC for One person Company & public limited company for public companies.

- Avoid names that sound too generic: Names like SPECIAL TRADERS LLP or General Traders should be avoided.

_1762157834.webp)

Before you apply for name reservation, make your name by following the tips for name approval. At JustStart, we can help you to register your name with proper confidentiality.

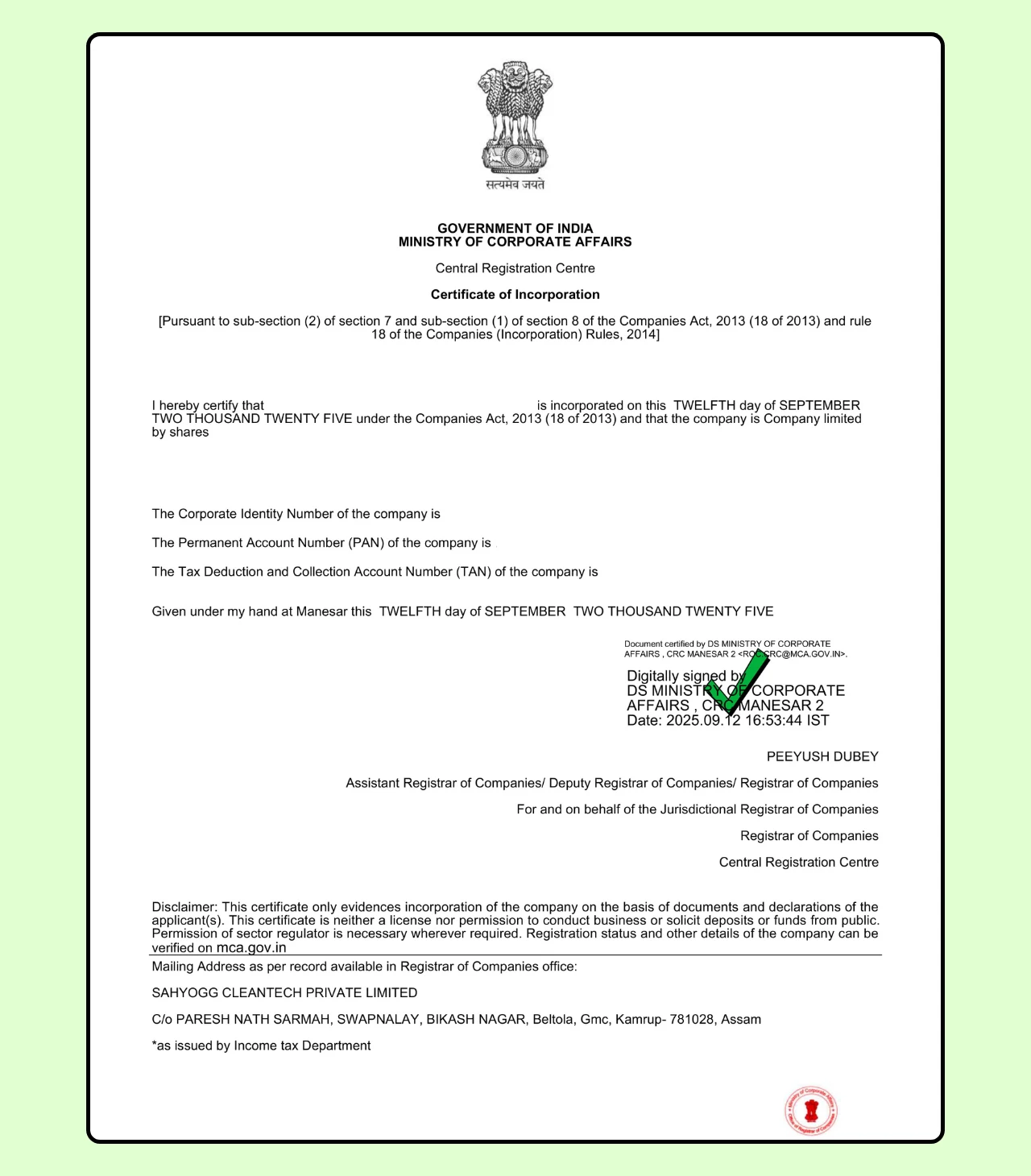

Certificate

Company Registration Certificate

An official document issued by the ROC (Registrar of Companies) signifies that your enterprise is legally registered as per Indian law, called the “Certificate of Incorporation”. It is also known as the Registration Certificate, and it marks the finalisation of all incorporation formalities.

The Certificate of Incorporation contains all the crucial information of a company as per the law, such as the official name of the company, the registered address of the company, the date of incorporation of the company, etc., along with a unique Corporate Identification Number (CIN Number). The CIN is a 21-digit alphanumeric number allotted to every company on incorporation, which gives a lot of information pertaining to the company, such as the company type, the year in which the company was incorporated, the state in which it was registered, the industry classification of the company, and the registration sequence number.

A Certificate of Incorporation is the most vital document for a company; it is indisputable legal evidence of the existence of a company, based upon which it can open a bank account of its own, enter into contracts, and operate its business

Compliances

Post-Registration Compliance

After incorporating your company in India, it is mandatory to file the post-registration compliances. It is properly based on the chosen business structure. However, mandatory post-registration compliances are:-

1. Commencement of business form: Form Inc-20 will be filed for the commencement of business within 6 months from the date of Incorporation.

2. Director’s KYC: DIR-3KYC form should be filed every year for updating the information of the directors/partners.

3. Return of deposits: Form DPT-3 requires information on deposits and non-deposits taken by the Company. If there are no deposits, then it is not mandatory to file the form.

4. Appointment of Auditor: Form ADT-1 filed for the appointment of an auditor in the company who will sign the financials of the company.

5. Financial statement return & Annual return: Form AOC-4 & MGT-7 are the most important forms for the company disclosures regarding the audited financial statements & annual return of the company.

6. Income Tax Return: Every company has to file an income tax return every year

7. Other compliance: Based on the business activities, depends upon the objects taken. Suppose a company engaged in the food business requires FSSAI licence, an importer-exporter requires an IEC number, and the GST holder complies with the GST compliances.

Why Choose JustStart?

Why Choose JustStart for Company Registration?

Starting a business is exciting, but incorporating it is practically not as easy as entrepreneurs think so. At JustStart, we make company registration fast, simple and stress-free so that the entrepreneurs will focus on their growth rather than compliance.

Fast Processing Time

Our experts complete the process very fast, helping you register your company without any unnecessary delays.

No Hidden Charges

Our prices are transparent, and there are no hidden charges. With JustStart, you get clear and upfront pricing so that you always know what you are paying for.

Expert Team of Professionals

JustStart is having a team of qualified professionals who understand your business requirements and then will start the process.

End-to-end Support

We not only incorporate your business, we assist even with the post-registration compliances so that your business will run smoothly without any delays and avoid huge penalties.

Structured Compliance Services

At JustStart, we can curate your compliance packages according to your business requirements.

Proven Track Record

Hundreds of startups across India trust JustStart services. Our client testimonials highlight our reliability, efficiency and quality services. As we commit, we do.

JustStart is your trusted partner for complete compliance support and

company registration online- all under one roof.

Locations

Company Registration in Other States and Cities

FAQs

LET'S CLEAR ALL THE DOUBTS!

There is no minimum paid-up capital required to register a company in India. You can register your company by just putting a small capital amount of ₹1000, also, allowing it to be accessible to startups and small businesses.

Registration of a company generally takes 7–10 days, depending on how complete your documents are and the Ministry of Corporate Affairs (MCA) approval process.

Foreign nationals can indeed register a company in India. At least one director should be an Indian resident, and the applicant must furnish a handful of mandatory documents, such as valid identification and proof of address, besides incorporation-related documents.

Click here to read more about Company Registration for Foreigners & NRIs

Some of those compliances would include:

- Filing annual returns with MCA

- Maintaining books of accounts and financial statements along with auditor's report

- Charging GST on applicable services/products

- Obtaining licenses as per the industry being ventured by the company

Yes, you can convert an existing sole proprietorship to a private limited company. This involves incorporation of a new company, the transfer of assets and liabilities, and completing formalities with the MCA.

Click here to find out which is better for your business- Sole Proprietorship vs Private Limited Company

The office address must be registered in the company registration online. However, it may also be a virtual office meeting all the legal requirements and MCA regulations.

Click here to read more about Company incorporation without Physical Office.

Non-compliance with the post company registration requirements can be penalized with late fees; the corporation can also risk getting struck off the register. An essential thing to maintain for keeping your company legally alive is to stay updated regarding annual filings and statutory requirements.

Using JustStart for company registration will give you fast and hassle-free registration services with expert guidance every step of the way. Moreover, it will offer transparent pricing, with no hidden costs, leading to a stress-free experience from start to finish.

A Certificate of Incorporation is an official document issued by the Ministry of Corporate Affairs when a company is registered. It proves that the company is legally recognized and includes details like the company name, registration number, and date of incorporation.

In India, a Private Limited Company enjoys the status of an irreversible one. It can, thus, continue to exist even after a change of directors and shareholders, which provides a certainty of long-term continuity for a particular business.

After receiving the Certificate of Incorporation, PAN and other registration documents, you can go to any bank to open a current account in the name of your company. These documents act as proof of the legal existence of the concerned company.