Overview

What is Employees' State Insurance (ESI) Registration?

ESI registration is a key step for any organisation that values employee health and social security. This government-backed scheme, run by the Employees' State Insurance Corporation (ESIC) under the Ministry of Labour and Employment, pools contributions from employers and employees into a shared fund each month.

Over time, this fund delivers essential medical care and cash support for challenges like illness, maternity, or work-related injuries. It extends coverage to employees and their families, easing financial pressures from rising healthcare costs. By registering, businesses not only build trust with their teams but also promote a more stable, productive workforce across India.

Reasons

Who Needs to Register for ESI?

If your business meets certain employee thresholds, ESIC registration is straightforward and essential. It protects your staff's health, keeps you aligned with labour laws, and creates a more transparent workplace.

Who Should Register -

Establishments with 10 or More Employees

In most regions, businesses with 10 or more employees need to register with ESIC. This covers factories, shops, offices, and other non-seasonal setups, giving your team reliable health safeguards.

Higher Threshold in Select States

States like Maharashtra and Uttar Pradesh set the bar at 20 employees. Whether private or public, this ensures consistent coverage where it matters most.

New Establishments Reaching the Threshold

Once your growing business hits the employee limit, register within 15 days. This keeps you ahead of penalties and fully in step with regulations.

Employees Earning Up to ₹21,000 Per Month

Coverage is mandatory for those earning up to ₹21,000 monthly (basic wages plus allowances), including up to ₹25,000 for workers with disabilities. It focuses on supporting lower-wage roles that need it most.

Contract and Temporary Workers

Include your contract or temporary staff in the process. This levels the playing field and reinforces fairness across your entire workforce.

Organisations under Government Contracts

If you are tied to government projects, ESI rules apply directly. It not only meets legal expectations but also boosts your standing as a dependable partner.

Voluntary Registration for Smaller Businesses

Even with fewer than 10 employees, you can join voluntarily through the SPREE 2025 scheme (Scheme for Promotion of Registration of Employers and Employees) - open until December 31, 2025 and extended date 31st January,2026. It's a smart way to show your commitment early and strengthen team loyalty.

Online ESI Registration creates a caring environment that

reduces stress and supports steady business progress.

Contribution Rates

Contribution Rates in Employees' State Insurance

Understanding ESI contributions is simple - they're designed to be fair and predictable. These required shares under ESIC help create a strong safety net for health needs.

ESI Contribution Breakdown

|

|

|

|

|---|---|---|

|

Just 0.75% of basic wages plus allowances, deducted seamlessly from their salary each month. |

3.25% of the employee's wages, bringing the total to 4% for the full fund. |

Skip deductions if daily average wages dip below ₹176. |

|

|

|

|

|---|---|---|

|

Just 0.75% of basic wages plus allowances, deducted seamlessly from their salary each month. |

3.25% of the employee's wages, bringing the total to 4% for the full fund. |

Skip deductions if daily average wages dip below ₹176. |

Take a team of 15 earning ₹15,000 monthly - Expect around ₹9,000 in total contributions, due by the 15th of the next month on the ESIC portal. Unchanged since 2019, these rates give you clear budgeting room. Plus, you can deduct your portion for tax benefits, and linking to payroll tools makes it even easier. Remember, late payments add 12% interest annually, so staying on schedule pays off. It's a small step that delivers big protection for everyone involved.

Benefits

Benefits of ESIC Registration Online

ESI Registration goes beyond paperwork - it's a real boost for both your business and your people. It offers health support, financial relief, and peace of mind that strengthen your team.

For Employers -

✅ Legal Compliance - Avoid fines and audits by fully meeting ESIC and labour law requirements, projecting a reliable image.

✅ Employee Retention - When staff feel valued through health benefits, satisfaction rises, turnover drops, and loyalty grows naturally.

✅ Credibility and Trust - Being registered provides integrity, earning respect from employees, clients, and oversight bodies alike.

✅ Build a Healthier, More Productive Team - Stress is reduced, and concentration is enhanced when workers are confident that their health requirements are met without any financial burden on them.

For Employees -

✅ Medical Stability - Free access to consultations, treatments, and drugs for you and up to three dependents - at ESIC centers or partnered hospitals, from check-ups to complex procedures.

✅ Sickness and Maternity Support - Get 70% of average wages for up to 91 days of certified illness; full pay for 26 weeks of maternity, including miscarriage aid.

✅ Injury and Emergency Aid - 90% wage coverage for temporary disablement; pensions for permanent cases; ₹15,000 for funerals; and up to 50% relief for unemployment via the Atal Beemit Vyakti Kalyan Yojana after 78 contribution days.

With ESI in place, you foster a healthier, more engaged workplace that drives results and shared success.

Documents Required

Documents Required for ESI Registration Online

Gathering the right documents for ESI registration keeps things moving smoothly on the ESIC portal. A complete set verifies your business and cuts down on back-and-forth.

For Proprietorships -

- Your name as the applicant

- PAN card

- Owner's ID proof (like Aadhaar, driving license, or passport)

- Your address proof

- Proof for business premises (such as a utility bill)

- Full contact details, including home address and phone

For Partnership Firms / LLP / Company -

- Business name (partnership firm, LLP, or company)

- Certificate of Registration for firms; Incorporation Certificate for LLP/company

- Partnership Deed, if applicable

- ID proofs for partners/directors (PAN, passport, driving license)

- Contact and address proofs for all partners/directors

Society/Trust -

- Registration with the appropriate authority

- Certificate of incorporation

- Memorandum and Articles of Association

- ID proofs for the president and members

- Complete details for president/members, including addresses and contacts

- PAN card for the society/trust

Common Documents Required for All Entities

- GST Registration Certificate (if you have one)

- Record of monthly employee numbers

- Salary/wage register, vouchers, and balance sheets from day one

- Employee details - joining dates, father's names, birth dates

- Salary and contribution records

- A cancelled cheque

With everything ready, your registration wraps up quickly and without surprises.

Procedure

ESI Registration Process in India

ESI registration is user-friendly, fast, and 100% online through the ESIC portal. These steps ensure everything's accurate and approvals come quickly, fitting right into your routine.

Step 1 – Sign up on the ESIC Portal -

Head to esic.gov.in, click "Employer" then "Register." Input your PAN, mobile, and email to get a temporary ID - login details arrive by email right away.

Step 2 – Form Submission -

Sign in and pick "New Employer Registration." Fill out Form-1 with your business details, employer info, staff numbers, and wages. Double-check for accuracy to skip any mistakes.

Step 3 – Document Upload -

Scan and attach your files, then e-sign with your digital signature certificate (DSC). The portal walks you through it clearly.

Step 4 – Verification -

ESIC checks your submission - usually within 2-3 days. Just reply to any questions directly in the portal.

Step 5 – Receive ESI Code -

Once approved, your 17-digit ESI code lands in your email or SMS. Start using it for contributions and reports immediately.

Following this path not only ticks compliance boxes but also gets your team covered fast.

ESI Card (Pehchan Card)

The e-Pehchan Card is your employee's go-to ID for ESI benefits - a unique 10-digit number that's yours for life. It can be linked to Aadhaar for easy portability, even if you switch jobs or cities, all managed through the ESIC portal.

It makes life simpler - After registering employees on the portal and doing their kyc’s, they generate the card in moments. Staff can pull theirs down with an OTP from their Insured Person account. Use it for instant, cashless care at ESIC spots for the whole family, track claims on the go, and handle transfers smoothly. With the Pehchan Card, everything's accountable and at your fingertips, putting real control back in employees' hands for their health journey.

Compliance

ESI Compliances in India

Staying on top of ESI compliance keeps benefits flowing smoothly for your team. It means depositing contributions monthly and filing spot-on returns with ESIC - simple habits that avoid headaches down the line.

(1)_1769067025.webp)

ESI Compliance Requirements -

Monthly Contributions - Pay up by the 15th of the next month to keep things current. Any slip could draw ESIC's review.

Filing Returns - Drop half-yearly Form-5 by May 11 (October-March period) and November 11 (April-September).

Updating Employee Records - Keep names, Aadhaar, and wage info fresh - outdated details can reject claims or moves.

Timely Pehchan Card Issuance - Get cards active for everyone right away. It lets them check contributions online and access care easily.

Good compliance earns trust, eliminates penalties, and keeps your operations solid.

Common Mistakes

Common Mistakes to Avoid in ESI Registration

It's easy for businesses to trip up on ESI registration details, but spotting these common pitfalls early saves time and trouble. As an ESIC must-do, even small slips can lead to delays or extra costs.

Mistakes to Avoid -

Incorrect Establishment Details - A mismatched business name, address, or PAN? That often sends your application straight back.

Incomplete Employee Data - Skipping or messing up names, Aadhaar, or salaries throws off contributions and setup.

Overlooking Pehchan Linking - Not connecting cards right away? It blocks easy tracking and benefit grabs, especially during transitions.

Delayed Document Submission - Holding off on proofs or certificates drags things out and risks fines.

Skipping DSC Verification - Forget the digital signature step, and your form stays unfinished - always verify to keep momentum.

_1764833308_1769067079.png)

Steering clear of these keeps your ESI rollout smooth, compliant, and focused on what counts - your team and your goals.

ESI Forms

Types of ESIC Forms

|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

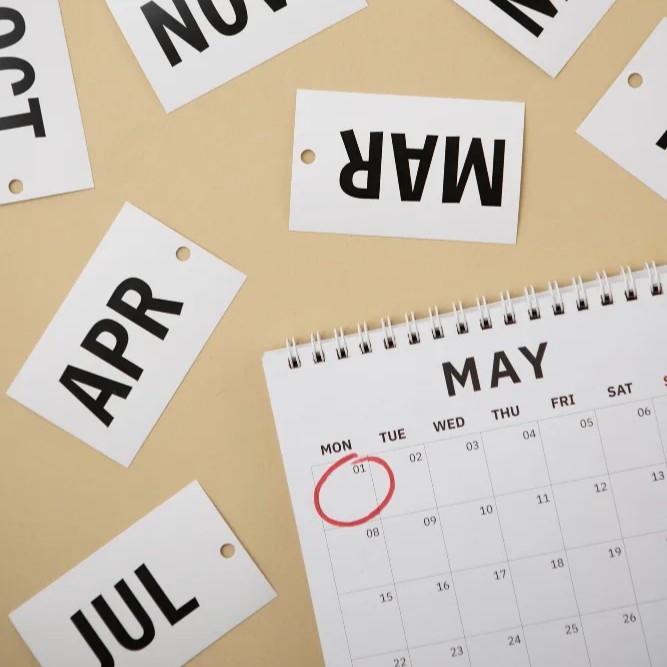

Due Dates

ESI Payment Due Date

The ESI payment due date marks when you need to send in employee contributions. It's set for the 15th of the month after, keeping credits timely.

ESI Contribution Due Date

Deduct 0.75% from paychecks, match with your 3.25%, and deposit the full 4% by the 15th via the ESIC portal. This gets funds where they're needed without delay.

Grace Period for ESI Payments

These days, there's no built-in grace - digital tools expect you on the dot by the 15th. Back when things were manual, a bit of wiggle room helped, but now it's all about precision.

Conditions for Deadline Applicability

Online systems apply to everyone, no exceptions. Hit that 15th mark to ensure seamless processing every time.

ESI Return Due Date

Half-yearly Form-5 goes in by May 11 for the October-to-March stretch and November 11 for April-to-September. It keeps ESIC informed and your compliance sharp.

Why Choose Us?

Why Choose JustStart for ESI Registration?

Pick JustStart, and ESI registration becomes a breeze. Our team tackles the details with speed and care, hitting every ESIC mark so you can pour energy into your business.

Expert Guidance

Our pros guide you through each phase, nailing the details every time.

End-to-End Service

From docs to sign-off, we cover it all without a hitch.

Rapid Processing

We cut the wait, delivering results when you need them.

Transparent Pricing

Straightforward costs mean no surprises - just real value.

Ongoing Support

Stick with us for returns, compliance checks, and updates long after launch.

Experienced Team

Decades of hands-on work in ESI setups and upkeep.

Client-Focused

Your ease comes first, with tailored updates and attention.

Locations

ESI Registration in States & Cities

FAQs

LET'S CLEAR ALL THE DOUBTS!

ESI registration enrolls businesses in a government health and social security scheme for employees. Administered by ESIC, it funds medical and cash benefits through shared contributions.

ESI is mandatory for establishments with 10+ employees in most areas (20+ in select states). Smaller firms can register voluntarily under SPREE 2025.

ESI registration starts with signing up on the ESIC portal using your PAN, mobile, and email. Complete Form-1, upload required documents, and submit for verification. Upon approval, you receive a 17-digit ESI code to begin contributions.

Establishments with 10 or more employees in most areas qualify for mandatory ESIC registration. Employees earning up to ₹21,000 per month also qualify. Smaller businesses can opt for voluntary coverage under the SPREE 2025 scheme.

ESIC applies mandatorily to employees earning up to ₹21,000 per month. Workers earning ₹25,000 per month with disabilities qualify. Those above ₹21,000 can join voluntarily with employer consent.

PF and ESI are not mandatory for establishments with fewer than 10 employees. However, businesses can choose voluntary ESI PF registration to provide benefits. This option builds employee trust and supports growth.

The minimum salary for an ESI card is any wage level, but mandatory coverage starts at up to ₹21,000 per month. Employees below this threshold receive the Pehchan Card automatically after registration. Higher earners need employer approval for inclusion.

PF becomes mandatory for employees earning above ₹15,000 per month in covered establishments. Employers must deduct and contribute to the Provident Fund for such employees. Pairing it with ESI enhances overall social security.

Establishments need 10 or more employees for mandatory ESI in most states. In areas like Maharashtra, the threshold is 20 employees. Voluntary registration remains available for smaller teams.

Late ESI contributions attract 12 percent annual interest. Repeated delays lead to damages up to 25 percent of the amount due. Businesses face fines or audits for ongoing non-compliance.

ESI Pehchan Cards do not require renewal as they remain valid for life once issued. Employees update details via the ESIC portal if needed. Contact ESIC support for any biometric or address changes.

ESI registration cannot be cancelled once initiated, but businesses can apply for exemption if employee numbers drop below the threshold. Submit Form-11 to the ESIC office with supporting documents. JustStart assists with exemption processes for eligible cases.