Introduction

A Director Identification Number (DIN) is mandatory for every director in an Indian company, a distinct 8-digit code issued by the Ministry of Corporate Affairs (MCA). This DIN is treated as an individual’s formal identification, and directors can use it to register in one or more corporations of India. No matter if you are incorporating a private limited company, LLP, or any other NGO, the first necessary step towards compliance is to get a DIN.

This manual will revolve around the Director Identification Number, and will comprehensively cover its significance, eligibility, a stepwise registration procedure, the necessary documents, and even how to check or modify it online.

What Is a Director Identification Number (DIN)?

A Director Identification Number (DIN) is an exclusive 8-digit figure allocated by the Ministry of Corporate Affairs (MCA) to signify a person’s capacity as a director of a company or companies in India.

Significant features:

- It is linked to a specific individual, not to a specific company. If you hold the position of a director in multiple companies, then you use the same DIN across all.

- The DIN is usually valid for life after being issued, except in cases where it is voluntarily relinquished, annulled, or suspended.

- If you are going to be the director of a company within the purview of the Companies Act, 2013, then you must have a DIN.l

- The DIN numbers assigned to the directors enable the MCA to put together a unified database of directors, thereby enhancing the capability to track, hold to account, and regulate.

To sum up: if you are or will be a director of an Indian company, then getting a DIN is a legal obligation as well as the starting point of corporate compliance.

Why DIN Matters: More Than Just a Number

It may seem like just an administrative detail, but DIN has significant legal and compliance implications:

Legal Authentication

A director's DIN must always accompany documents like annual returns, resolutions, etc., that are submitted to the MCA or other regulators. It serves as a “signature identifier.”

Single Source of Truth

The unique DIN assigned to each director eliminates the possibility of duplicating or misunderstanding who the director is. Moreover, it allows the regulators and third parties (creditors, investors) to audit the directorship histories without confusion.

Enabling Compliances & Filings

Various MCA forms (such as DIR-12 for appointments, DIR-3 KYC, and annual returns) are associated with DIN. A deactivated DIN (e.g., due to non-KYC) may cause a barrier to further filings.

Governance, Transparency, and Anti-fraud Objectives

The DIN + annual KYC program is part of MCA’s strategy to eliminate shell companies, impersonation, and the misuse of directorships.

Hence, treating DIN as a trivial matter is risky. It’s the foundation of the director’s identity in India.

_page-0001_1761633856.webp)

Who Must Obtain a DIN, and When?

If you intend to become a director in an Indian company (including private or public), you are obligated to acquire a DIN. Here are a few points:

- If a director vacancy arises and you don't possess a DIN, you must apply for Form DIR-3.

- If a new company formation is going on, and you are one of the first directors, the company incorporation process (through SPICe+ / INC-32) allows simultaneous DIN allotment for the directors.

- If you no longer hold the post of a director in any company, but your DIN remains active (meaning it has not been surrendered or deactivated), you will still need to meet certain compliance requirements (like annual KYC).

- Foreign nationals who want to be directors in Indian companies have to go through the same process as locals to get a DIN, but they have to follow further procedural and document requirements.

Read more about Company Registration for Foreigners & NRIs

How to Apply for a DIN (Step-by-Step)

The following is a process map that demonstrates how to get a DIN number and has been updated to the present day.

1. Obtain a Digital Signature Certificate (DSC)

A Class 2 or Class 3 DSC (issued in your name) is required to apply for DIN and sign all the documents digitally.

Check that:

- The DSC has not expired.

- The DSC has been linked to your MCA portal account.

- Name, PAN, and DSC certificate should match because the MCA checks the consistency.

2. Select the appropriate path: SPICe+ or DIR-3

SPICe+ (for new incorporation)

- If a new company is being formed, the SPICe+ form (INC-32) allows the application of DINs for three directors at the same time.

- The procedure is as follows:

- Indicate the option for DIN allotment for proposed directors in "Part B" of SPICe+.

- Fill in the required personal and identity details.

- Enclose identity and address proofs.

- Use DSC for signing.

- Since you won't have to file a separate DIR-3 later, this path is time-saving.

DIR-3 (for existing companies or standalone DIN application)

- If you are a director in an already-existing firm (or applying for DIN individually), you need to submit eForm DIR-3.

- In DIR-3:

- Provide personal details such as name, father's name, date of birth, PAN, address, and so forth.

- Enclose the identity proof (PAN for Indians; passport for others) and the address proof.

- Provide the resolution of the board regarding your appointment (if it is in the existing company), along with the CIN and signature of authorized persons.

- The form must be digitally signed by you and digitally verified by a practicing professional (CA/CS/CMA) in full-time practice.

- After that, pay the filing fee that has been prescribed (the amount may vary; often it is nominal).

- The MCA then checks the application and, if everything is okay, issues the DIN (usually within days) and notifies you by email.

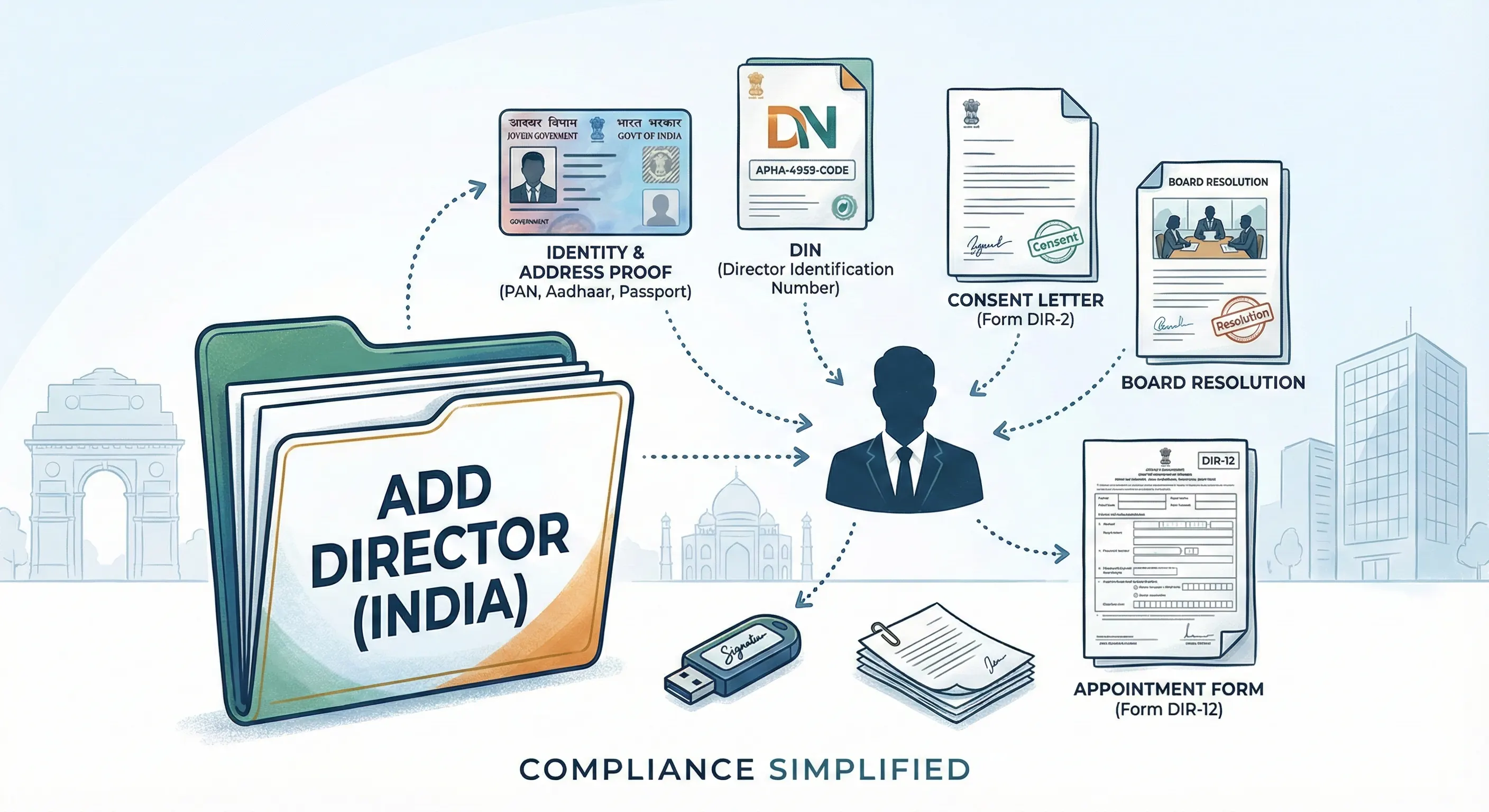

3. After DIN is allotted: follow-through steps

- It is required that you notify all the companies where you hold directorships about your DIN within a month of allotment.

- Then, that particular company will have to inform the Registrar of Companies (RoC) through Form DIR-12 to make the necessary updates in the records.

4. Monitor your DIN status

Through the MCA’s DIN search or the MCA portal, you need to frequently verify the status of your DIN (Approved, Deactivated, etc.) to pinpoint problems at an early stage.

DIN for Foreign Directors: Special Considerations

If you are a foreign national who wants to become a director of an Indian company, you will have to take some additional steps:

- Your valid passport is your main identity proof.

- In some jurisdictions, your address proof from your country may require notarization and apostille (or legalization).

- You still need a DSC; you can get one from a certifying authority that is recognized under Indian law or accepted by the MCA.

- The DIN application is considered in the same way, but there is a closer examination of foreign documents.

- Once the DIN is allotted, the same obligations (such as KYC) are imposed.

What Is DIR-3 KYC (Annual KYC for Directors)?

The MCA requires an annual KYC (Know Your Customer) procedure, designated DIR-3 KYC after getting a DIN. This is to keep the database of directors accurate and up to date.

What does DIR-3 KYC involve?

- Verification of your personal information: full name, date of birth, PAN, Aadhaar (or passport), home address, email ID, and mobile number.

- In the case of a first KYC or if there is a change in your details, you will have to apply for eForm DIR-3 KYC (PDF-enabled) along with the relevant documents and digital signatures.

- If you filed KYC in the previous year and nothing has changed, you can go for the DIR-3 KYC Web, which is a simple, OTP-based verification without document upload or professional certification.

Who must file DIR-3 KYC?

- Every individual with a DIN in "Approved" status on 31 March of a financial year must file DIR-3 KYC by 30 September of that year.

- This is the case even if you are not a director in any company as of 31 March. KYC is mandatory as long as your DIN is active.

- If your DIN was issued after 31 March that financial year, your first KYC is next year.

Deadline & penalty

- Due date: 30 September of the financial year.

- Your DIN will be deactivated (status: "Deactivated due to non-filing of DIR-3 KYC"), and a penalty of ₹5,000 will be charged if DIR-3 KYC is not submitted on time.

- To reactivate, KYC (eForm or web) should be filed, and a penalty should be paid.

- You might be blocked from any further MCA filings that require directors until the DIN is reactivated.

How to File DIR-3 KYC: Step-by-Step

Option A: eForm DIR-3 KYC (first time / updated details/reactivations)

This is a more elaborate form with document attachments and certifications

- Get the form and the instructions from the MCA site.

- Enter your personal details: DIN, name, father’s name, date of birth, PAN number, Aadhaar (or passport), address, phone number, etc.

- Put in the supporting documents:

- PAN card (for Indian citizens)

- Aadhaar or passport (for non-Indians)

- Proof of address (utility bill, bank statement, etc.)

- A photograph that’s passport-size and recent

- Generate OTPs for your mobile and email, and verify them.

- Attach DSC (digital signature).

- The professional (CA / CS / CMA) certifies – they have to electronically sign and approve.

- File the form, pay any penalty if it’s a reactivation case, and receive SRN (Service Request Number) as a receipt.

- Check the status on the MCA portal.

Option B: DIR-3 KYC Web (for unchanged KYC data)

This is intended for DIN holders who have already submitted KYC in the past and whose KYC data has not changed.

Steps:

- Go to the MCA portal → under DIN-related filings; access the service “DIR-3 KYC Web”

- Type in your DIN; the email and mobile number will be filled in automatically (from previous records).

- Check the declaration and file it.

- You will receive SRN / acknowledgement.

No DSC, no document upload, no professional certification needed.

Common Mistakes & How to Avoid Them

Although the process may seem simple, numerous DIN / KYC applications are either delayed or rejected because of errors that are easy to spot. Below are common mistakes and their remedies:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you are systematic and scrutinize each field meticulously, you will not only eliminate delays but also avoid adverse consequences.

DIN Statuses, Cancellation, Surrender & Reactivation

Statuses you may see

- Approved: Active and compliant.

- Deactivated due to non-filing of KYC: Both penalized and inactive until KYC done.

- Cancelled / Surrendered: If DIN is given up (rare) formally.

- Deactivated due to duplication/fraud: In extreme situations, DIN may be annulled by the MCA.

Surrender/cancellation (rare and restrictive)

A DIN can be surrendered using Form DIR-5 only under limited conditions. But once you have held directorships, it is not easy to surrender because your history is recorded in the system.

Cancellation by MCA can happen if:

- It was acquired fraudulently.

- It was a duplicate.

- The individual is dead or declared of unsound mind.

- Insolvency or disqualifications under the Companies Act.

Reactivation

If your DIN is deactivated due to non-KYC, you can reactivate by filing DIR-3 KYC (as eForm, since reactivation requires a full form) and paying a penalty of ₹5,000. The status becomes Approved again once it is processed.

Timeline & Key Compliance Calendar (for a Director)

Here’s a simplified timeline (for reference) to make sure you don’t miss critical dates:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real-World Tips For You

- Apply Early, Not Late

Filing in September will automatically mean taking unnecessary risks like the expiration date of DSC, increased loads on servers, and overlooking important details. Better yet, do it in July or, at worst, in August. - Align PAN / Aadhaar / MCA Database

These three sources are constantly compared. A slight change in one of them may even cause your application to be rejected. - Provide up-to-date, Clear Scans

Proofs of residence older than 2 months, blurry PDFs, or mismatched multi-page scans are still the most common reasons for rejection. - Regularly Check your DIN Status

Once issued, occasionally verify through MCA’s DIN master or portal. In case you see “Deactivated”, take action immediately. - Getting Professional Help is still Good (but check yourself)

There are a lot of CA/CS firms that do DIN/KYC filing. Even then, take the time to go through each field personally before the submission.

Conclusion

The obtaining of Director Identification Number (DIN) is the initial and paramount measure towards being an acceptable and trustworthy company director in India. This step not only provides your legal identification but also consumes your accountability and communication with the Ministry of Corporate Affairs. It is best to stay proactive because missing KYC updates or filing incorrectly can lead to penalties and adherence to compliance hurdles.

If you are looking for a stress-free DIN registration or annual KYC filing, then JustStart is the right place for you to connect with, our professionals facilitate the whole process to be simple, accurate, and compliant from the beginning to the end.

Frequently Asked Questions (FAQs)

Q1. Is it possible for me to reuse my DIN if it is from a previous company?

Absolutely. DIN is connected to a person and can be used in various directorships. A DIN is not necessary when a new company is entered.

Q2. Would I be able to act as a director if I miss the DIR-3 KYC deadline?

Not at all. When your DIN gets inactive for non-KYC, then you would be unable to file any MCA forms requiring a director's signature until the director's signature is reactivated.

Q3. Is there any cost involved in filing DIR-3 KYC (if filing done before the due date)?

There is no cost involved. If filed before the 30th of September, there is no government fee. Only late filers pay the penalty.

Q4. If my email or mobile changes, can I use DIR-3 KYC Web?

No. In case your details are changed, you would be required to file eForm DIR-3 KYC with the updated documents. Web mode is only applicable for unchanged details.

Q5. How long does it take via DIR-3 for DIN to be allotted?

Normally, a few business days (1–3), provided all the documents and forms are in place. Delays often occur because of mismatches or document problems.

Q6. Would I be able to renounce a DIN even if I were a director?

This is possible through Form DIR-5, but it is under very limited conditions. Surrender gets complicated for the person who has been a director, and there are records.