Many of you may not be aware of the regulatory compliances or turnover limits for LLPs, but that’s okay. We are here to help you, guide you at every step, and keep you on track. In this blog post, we will discuss LLP annual compliance and the turnover limits for audits.

The only way to avoid heavy penalties is by managing your compliance processes effectively. Don’t let a lack of awareness harm your firm’s reputation. Seek guidance from our experts and fulfil the mandatory business requirements on time. JustStart is here to support you.

What is a Limited Liability Partnership?

A Limited Liability Partnership (LLP) in India is a business entity regulated under the Limited Liability Partnership Act, 2008, and LLP Rules, 2009. It offers flexibility and scalability to its partners while having a separate legal identity with perpetual existence. However, each partner is responsible for their actions.

Like any other business, LLPs must comply with certain regulations on an annual basis to avoid legal action.

What are the LLP Annual Compliance Requirements?

LLPs must file annual reports with the Ministry of Corporate Affairs (MCA) to ensure legal compliance. This process involves submitting various forms, records, and documents on time to avoid penalties. The key requirements are:

- Form-11 (Annual Return): This form must be filed within 60 days after the close of the financial year. It includes details of management, partners, and business activities.

- Form-8 (Statement of Account and Solvency): This form must be filed within 30 days after six months from the end of the financial year. It updates the financial position of the firm.

- Income Tax Return: This must be submitted to the Income Tax Department, representing the firm’s tax liability and income. Ensure proof of tax payment is attached with other necessary documents.

What is the Turnover Limit for LLP Audit?

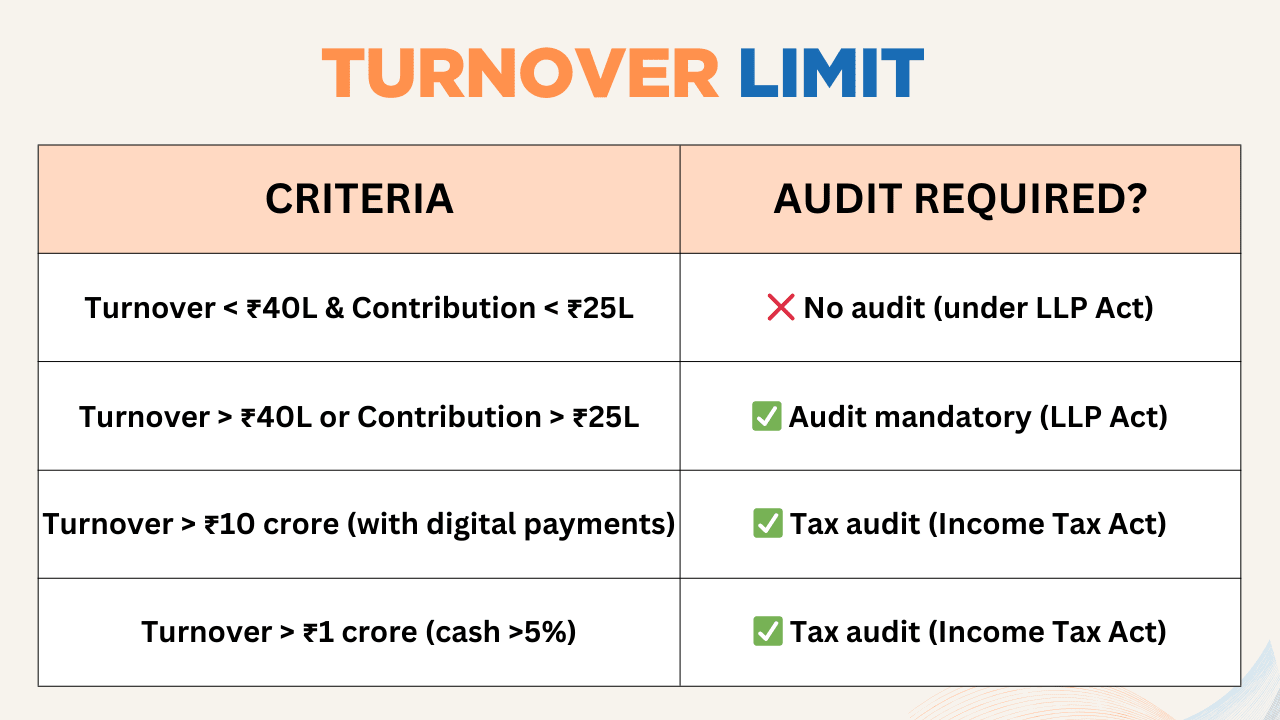

LLPs in India are required to undergo an audit based on specific turnover limits as prescribed by the LLP Act, 2008. The audit requirements also intersect with provisions of the Income Tax Act, 1961, in some cases:

Audit Requirement Under LLP Act, 2008:

- No Audit Required:

If the annual turnover is less than ₹40 lakhs and the contribution does not exceed ₹25 lakhs, an audit is not mandatory under the LLP Act. - Audit Mandatory:

If either: - Turnover exceeds ₹40 lakhs

- Contribution exceeds ₹25 lakhs

Then, an audit of accounts by a practising Chartered Accountant is mandatory under the LLP Act.

Note: Both turnover and contribution thresholds must be within the limit to claim exemption.

Tax Audit Under Income Tax Act, 1961:

Turnover up to ₹10 crores:

No tax audit is required if:

- Total cash receipts and payments do not exceed 5% of total transactions.

- You opt for the presumptive taxation scheme (if eligible).

Tax Audit Required:

- If turnover exceeds ₹10 crores (as per Section 44AB).

- If turnover exceeds ₹1 crore and cash transactions are more than 5% of total transactions.

Many people believe that LLPs must undergo an audit only based on turnover. But under the LLP Act, contribution (capital) is equally important. If your contribution is ₹30 lakhs (even with a turnover of ₹10 lakhs), audit is still mandatory.

What are the Consequences of Non-Compliance for LLPs?

If you are involved in business activities, maintaining transparency is essential. It becomes your responsibility to present accurate records and meet all legal requirements within the specified timelines.

Failure to comply can result in severe penalties, not just financially but also reputationally. Fines may be imposed by the Income Tax Department or the Registrar of Companies, and legal action could be taken against the Limited Liability Partnership and its partners.

Frequently Asked Questions:

Q. Do LLPs have to conduct regular audits?

A. Yes, but only if the turnover exceeds the prescribed limit. Regular audits help maintain transparency and good governance.

Q. What is the purpose of an audit in LLPs?

A. Audits ensure reliability and accuracy in financial reporting and assess the solvency of the firm.

Q. What documents are required for annual compliance?

A. The required documents include the firm’s notes to accounts, partners’ details, address proof, certificate of practice, and statements of assets and liabilities. These documents must be pre-verified by a Chartered Accountant (CA).

Conclusion

LLP Annual Compliance is critical for smooth business operations. Stay aware of all legal requirements, and consult a professional for timely audits and compliance. If you have any queries, feel free to contact us.